- Home

- Podprti posredniki

- eToro

How to Fill Your eToro Taxes in 2025 - Tax-Wizard

Calculate your eToro investment taxes easily with Tax-Wizard. Automate eToro tax reporting and simplify your 2025 tax declaration process.

This guide is designed to assist anyone who have investments on eToro and is seeking clarity on how to pay taxes. The information provided here should be useful when calculating your eToro taxes. However, it’s important to supplement this guide with the tax regulations specific to your country.

If you need to calculate taxes for your eToro investments, you’re in the right place! There are several ways to do this, such as calculating taxes manually in Excel, using an automated tax tool like Tax-wizard, or hiring a tax professional. Your choice will often depend on your budget and preferences.

How to export your eToro Account Statement

Start by Login to your eToro account.

In order to guarantee that the system will behave properly you should first configure your eToro

language to English.

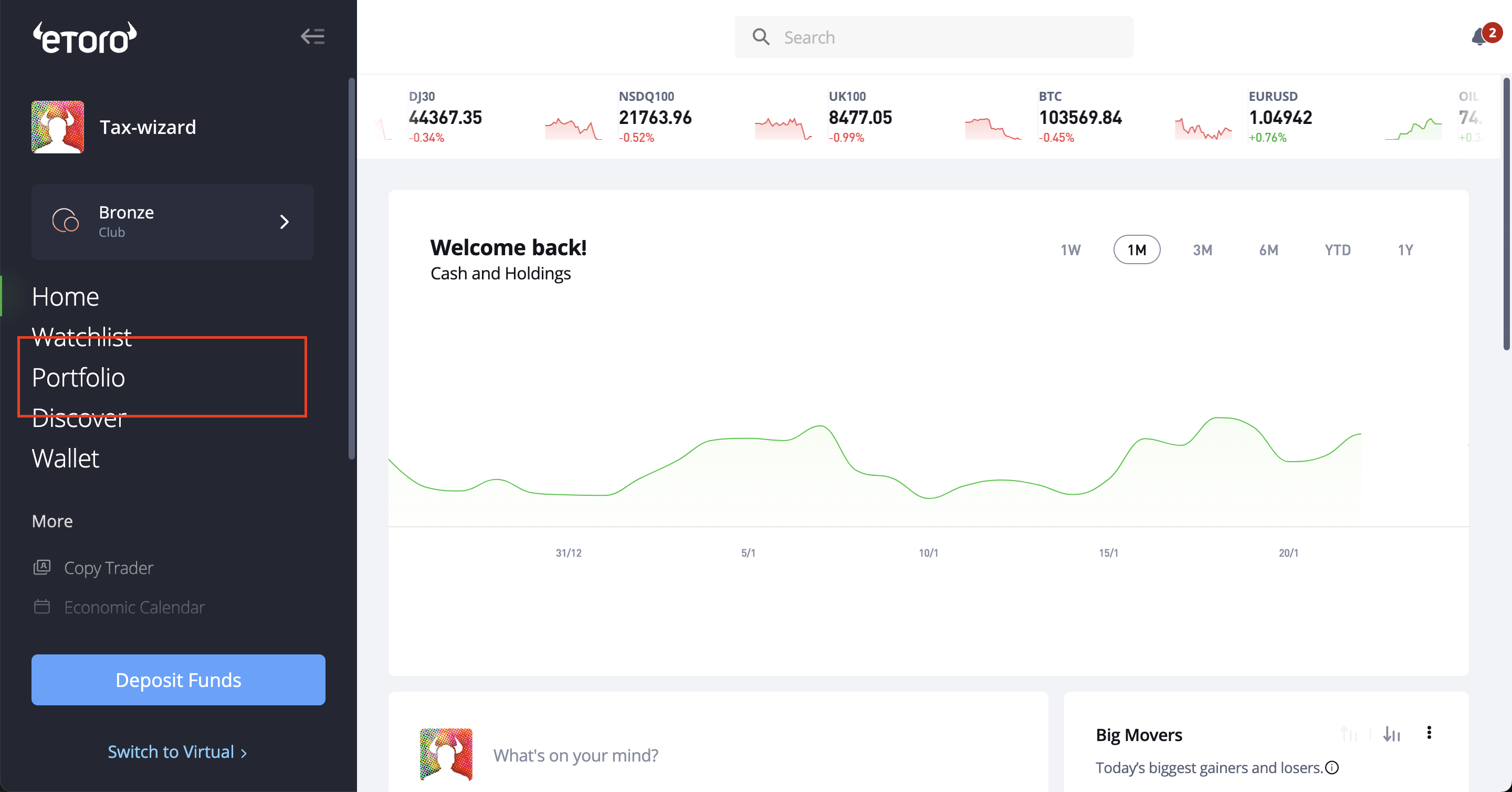

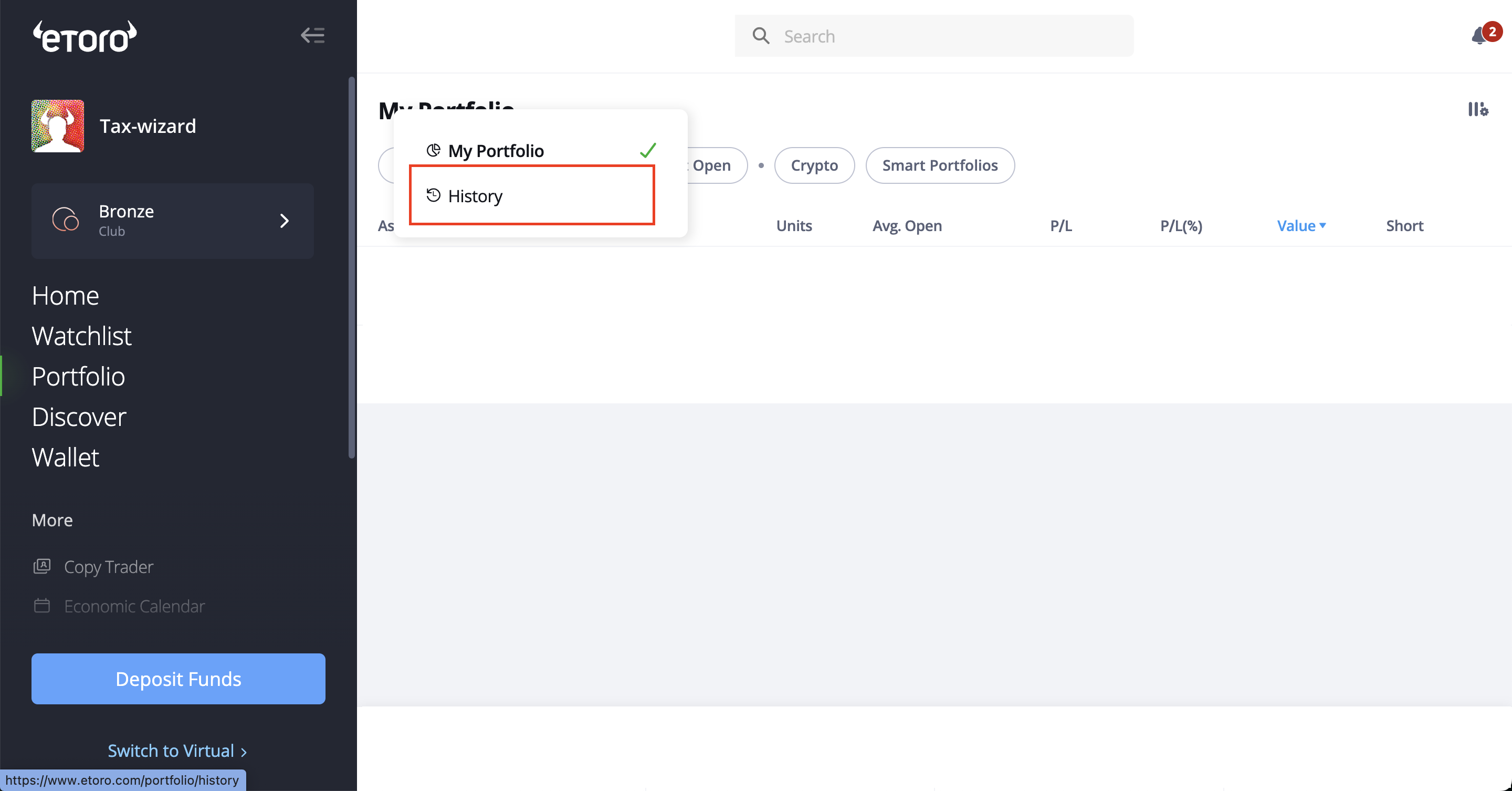

After ensuring your eToro language configuration is set to English; use the lateral menu in your eToro account to access your "Portfolio" from there is possible to navigate to your "History".

On the "Portfolio" page select "History" as seen in the image below.

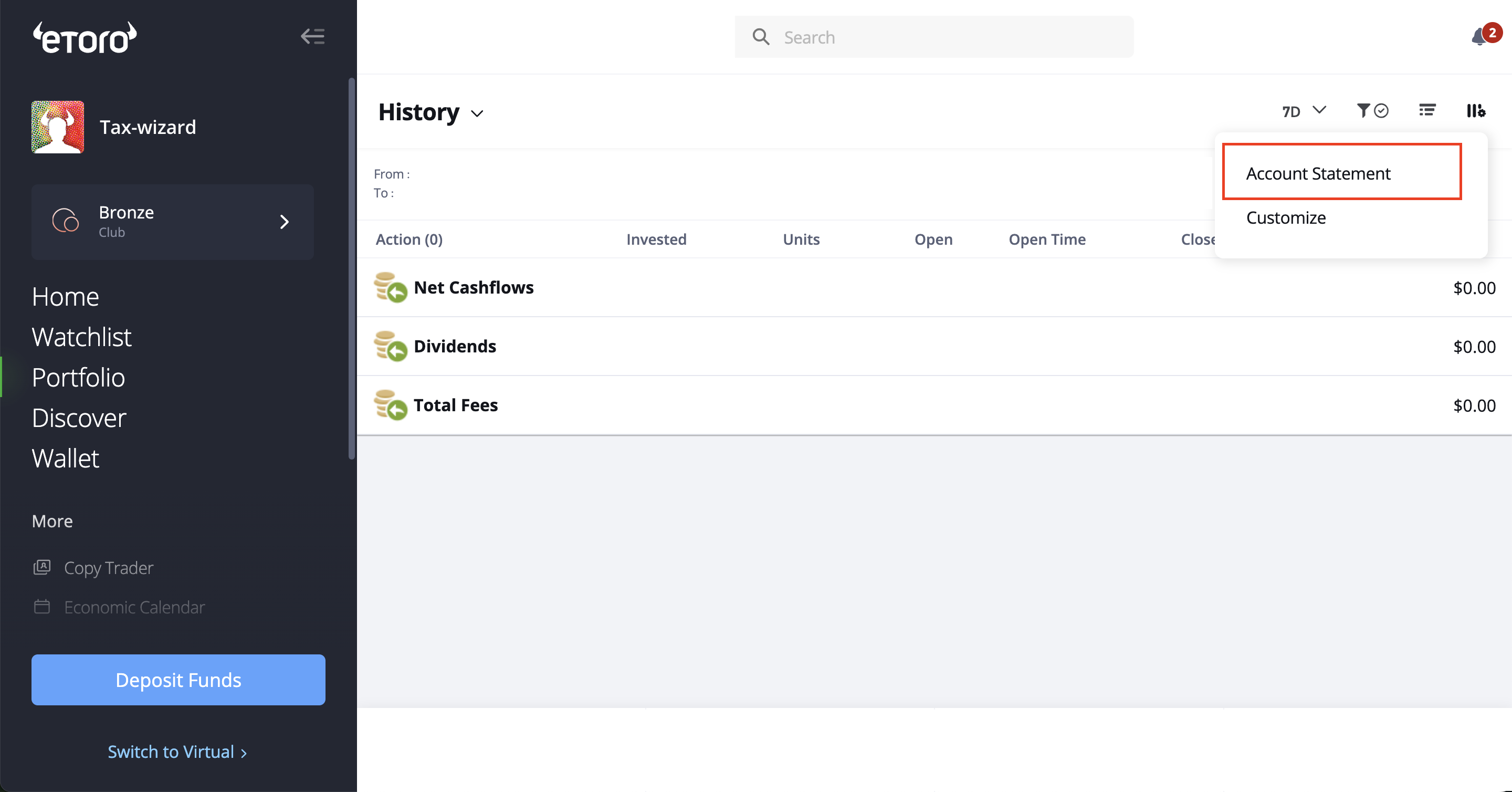

On the "History" page, on the top right menu as shown in the image below you can select the option to navigate to your "Account Statement".

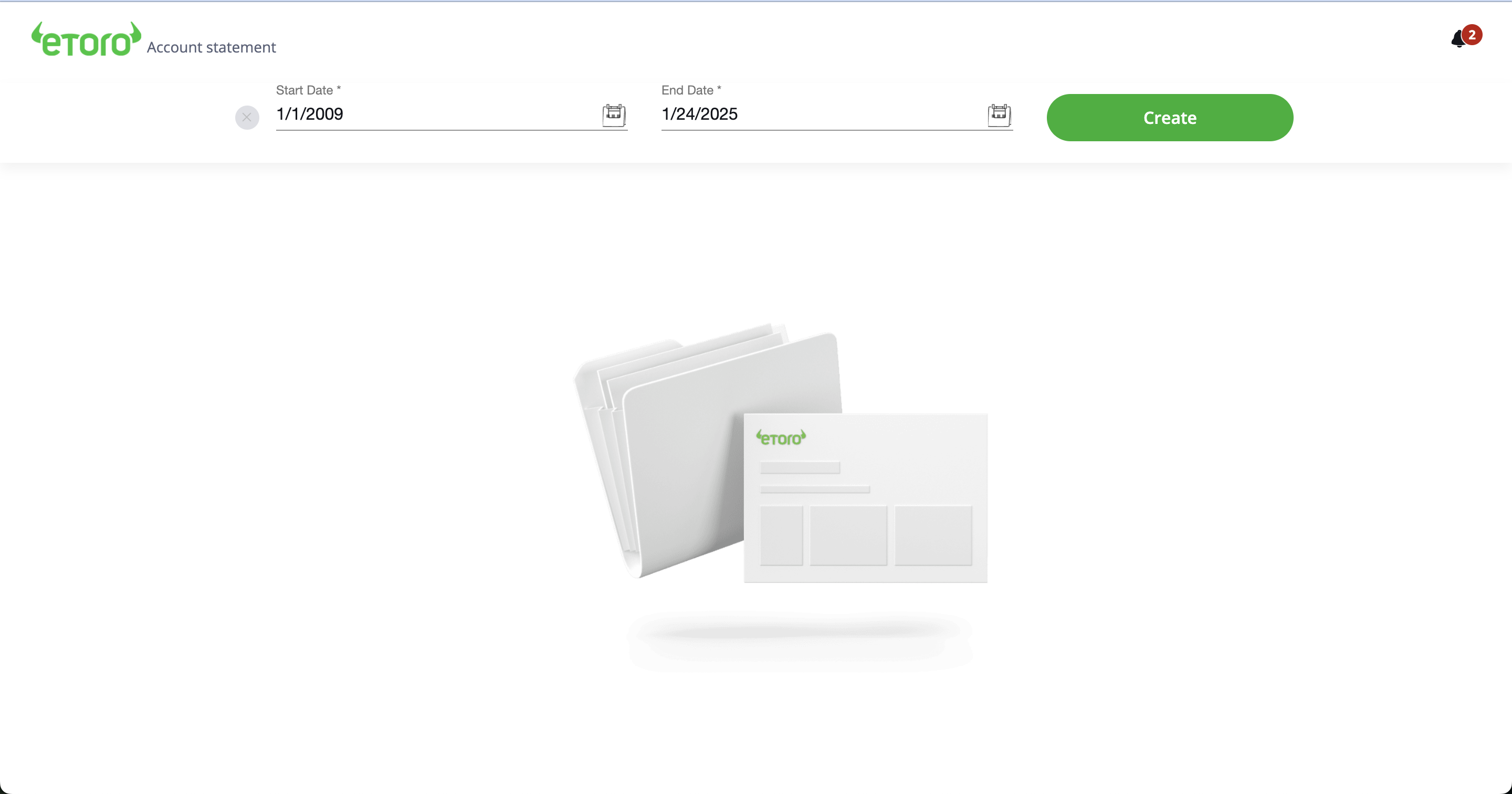

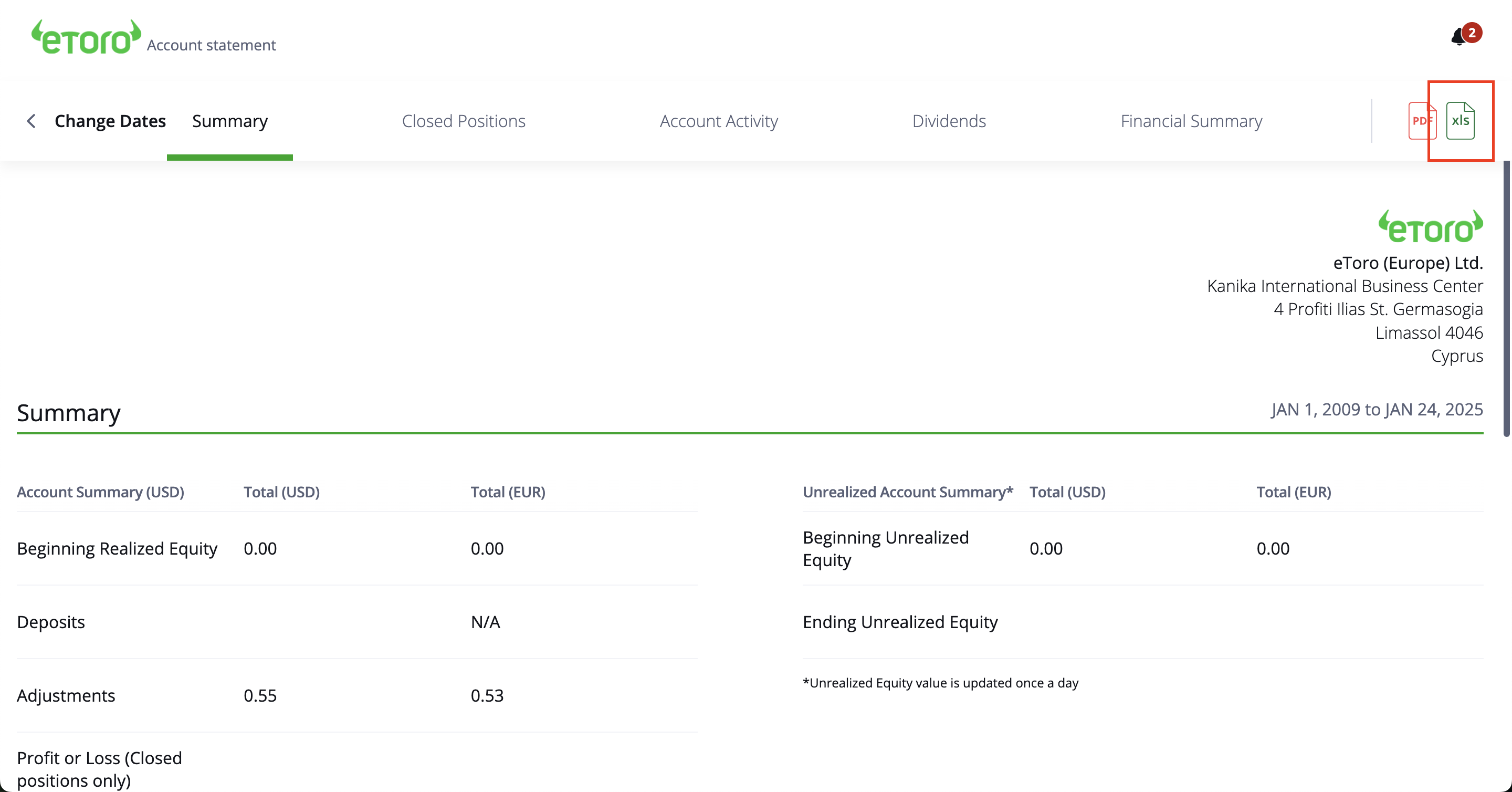

On your "Account Statement" page you should select the earliest possible start date, and the latest possible end date. This will ensure you have all the necessary information for your tax report. After selecting the dates, click on the "Create".

An "Account Statement" will be generated for you and after that you'll only need to download it in the XLS format.

By following these steps, you can ensure you have the correct files needed to use with Tax-wizard.

From here you can upload them to Tax-wizard and have your tax report ready in minutes.

Koliko je res vreden vaš čas?

Upoštevajte vrednost svojega časa in mir, ki ga prinaša zanesljivo in natančno orodje za davčno poročanje

(ni naročnina, brez samodejnega podaljšanja)

Premium

Vse funkcije za Revolut, Degiro, eToro, XTB, Trading212, Interactive Brokers, Freedom24, Lightyear, Trade Republic, Coinbase, Robinhood Crypto,...

- Podpora za vse posrednike in valute

- Samodejni izračun kapitalskih dobičkov

- Poročilo s pridobitvami, realizacijami, dividendami in obrestmi

- Poročilo o odprtih pozicijah in statistika

- Statistika transakcij in dividend

- Izvoz odprtih pozicij v Yahoo Finance

Business

Vse premium funkcije za računovodje, finančne svetovalce, davčne svetovalce ali druge strokovnjake in podjetja, ki želijo uporabljati Tax-Wizard za več strank.

- Podpora za vse posrednike in valute

- Samodejni izračun kapitalskih dobičkov

- Poročilo s pridobitvami, realizacijami, dividendami in obrestmi

- Poročilo o odprtih pozicijah in statistika

- Statistika transakcij in dividend

- Izvoz odprtih pozicij v Yahoo Finance