- Home

- Podprti posredniki

- Degiro

How to Fill Your Degiro Taxes in 2025 - Tax-Wizard

Easily calculate your Degiro taxes with Tax-Wizard. Automate Degiro tax reporting and simplify your 2025 tax declaration process.

For seamless integration with Tax-wizard, you need to download specific files from your Degiro account. On this guide we'll show you:

- - How to download Degiro Account Statement, which contains the details about your transactions, dividends, and corporate actions;

- - How to export Degiro Transactions List, which contains all purchases and sales you made;

- - How to download Degiro Annual Report, which contains the information about your account balance and the total value of your investments.

The Degiro Annual Report for each fiscal year is sent at the beggining of the following year. The required files are then:

- - Account Statement (CSV format)

- - Transactions List (CSV format)

- - Annual Report (PDF format)

Using these files, Tax-wizard can automatically prepare all the details for you to fill your tax report.

Steps to Download the Required Files

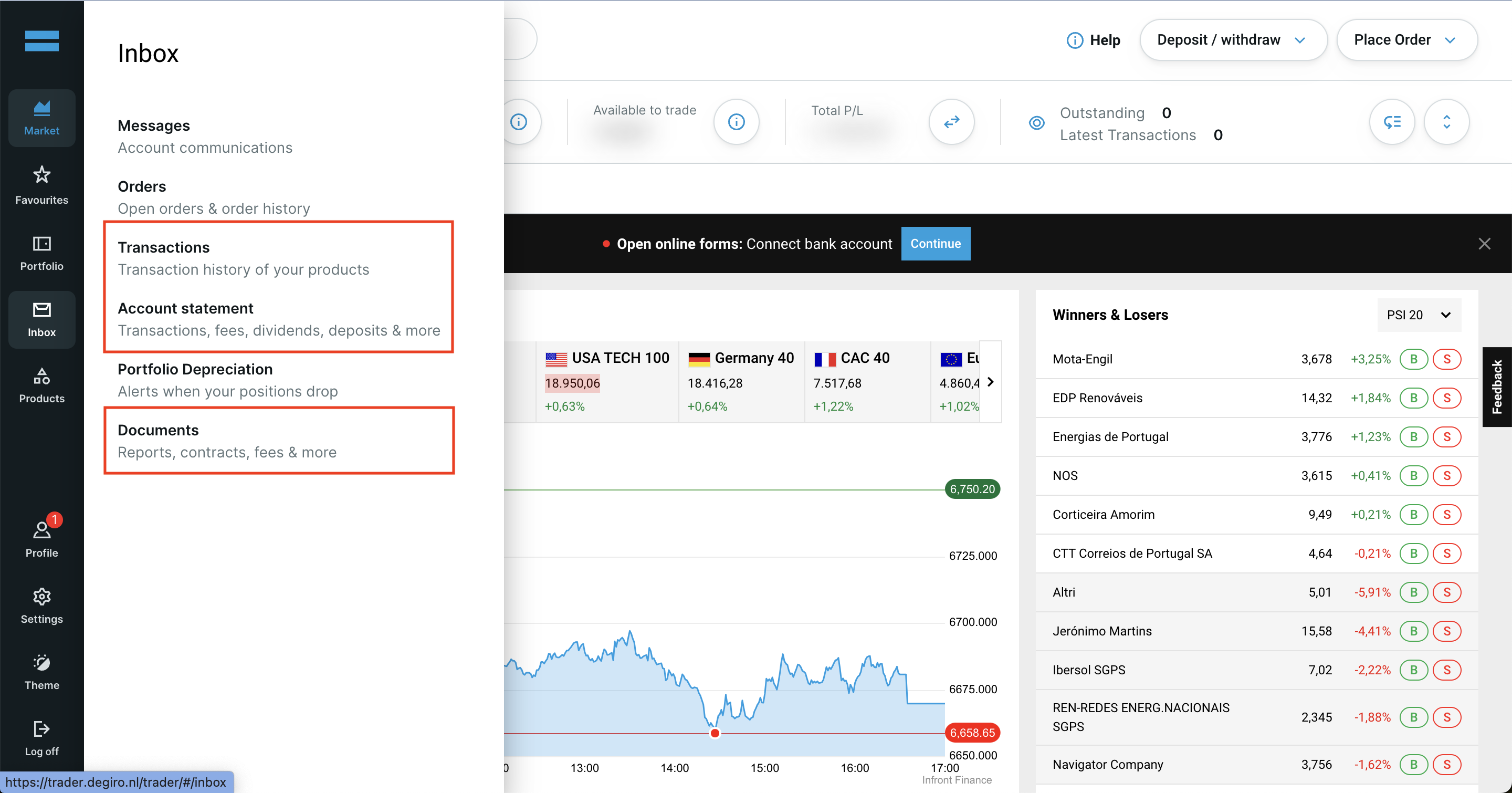

Use the side menu in your Degiro account to access Transactions, Account Statement, and Documents.

Important: Make sure to select the same period for the Account Statement and Transactions List, starting from the date your account was opened.

Start by logging in to your Degiro account and to navigate to your Degiro dashboard.

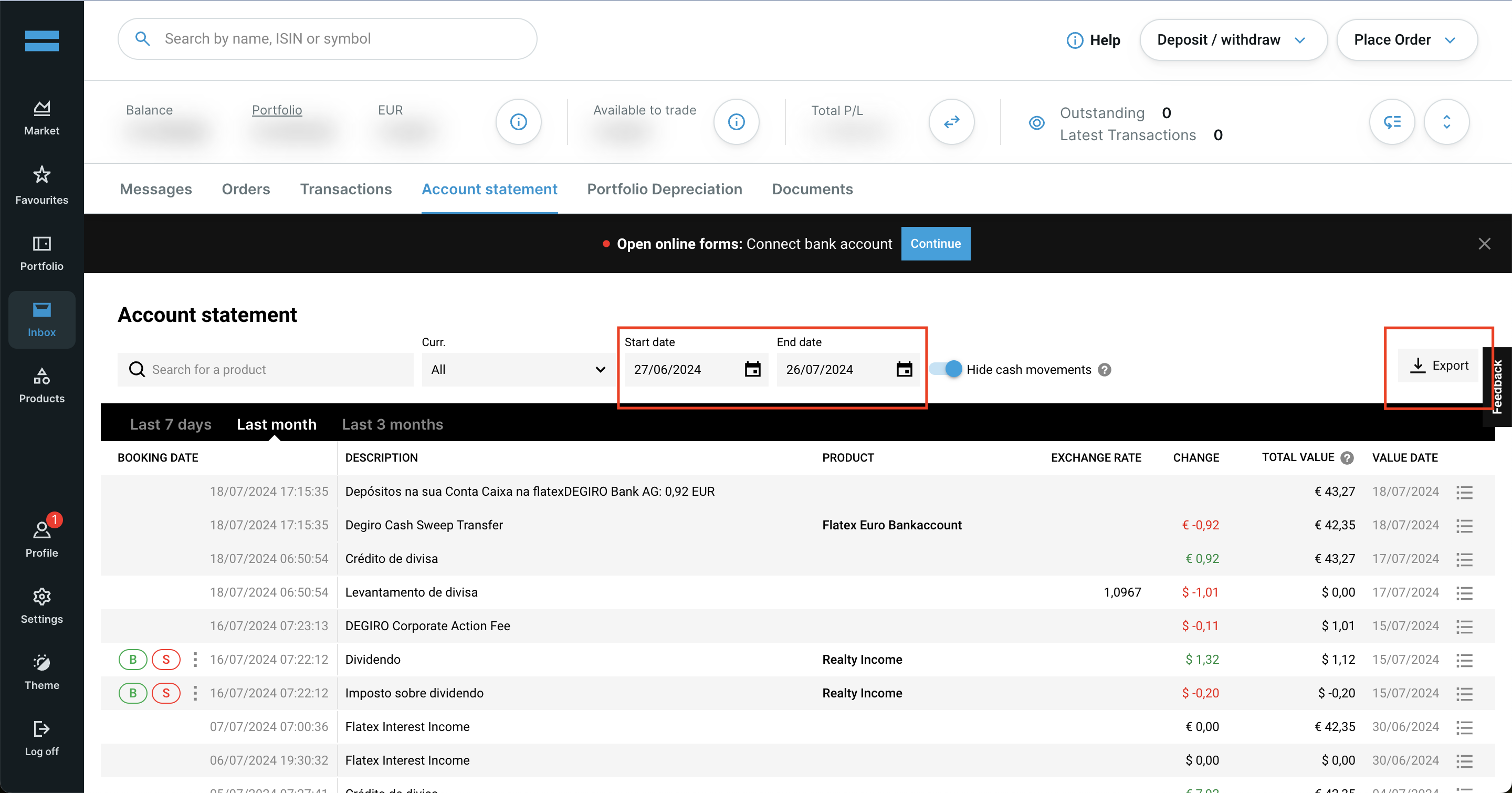

Download the Account Statement (CSV) from Degiro:

- 1. Go to the Account Statement section in your Degiro account.

- 2. Select the start date as the date your Degiro account was opened and the end date as today.

- 3. Click on the Export button and choose CSV format.

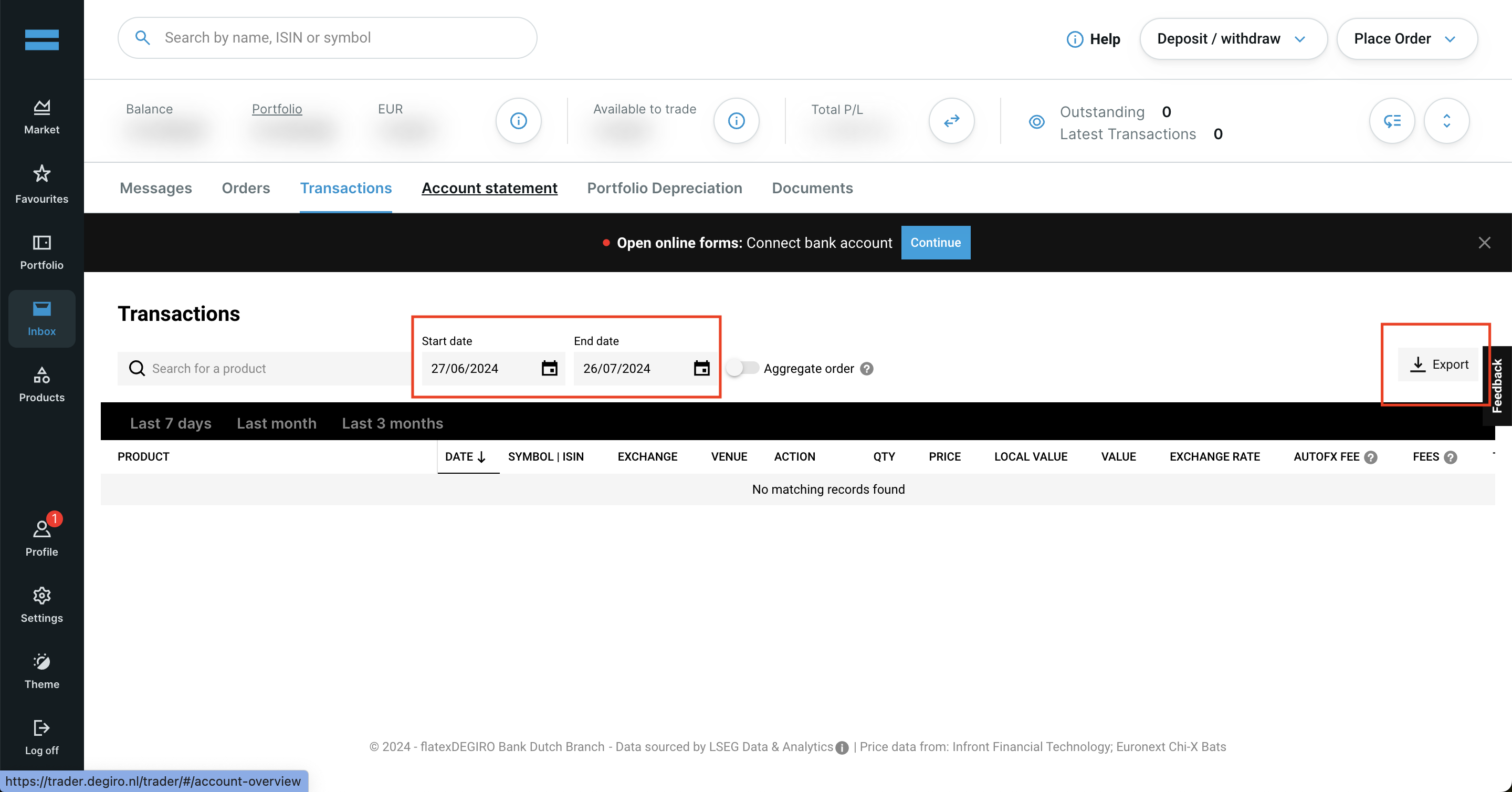

Download the Transactions List (CSV) from Degiro

- 1. Go to the Transactions section in your Degiro account.

- 2. Select the start date as the date your Degiro account was opened and the end date as today.

- 3. Click on the Export button and choose CSV format.

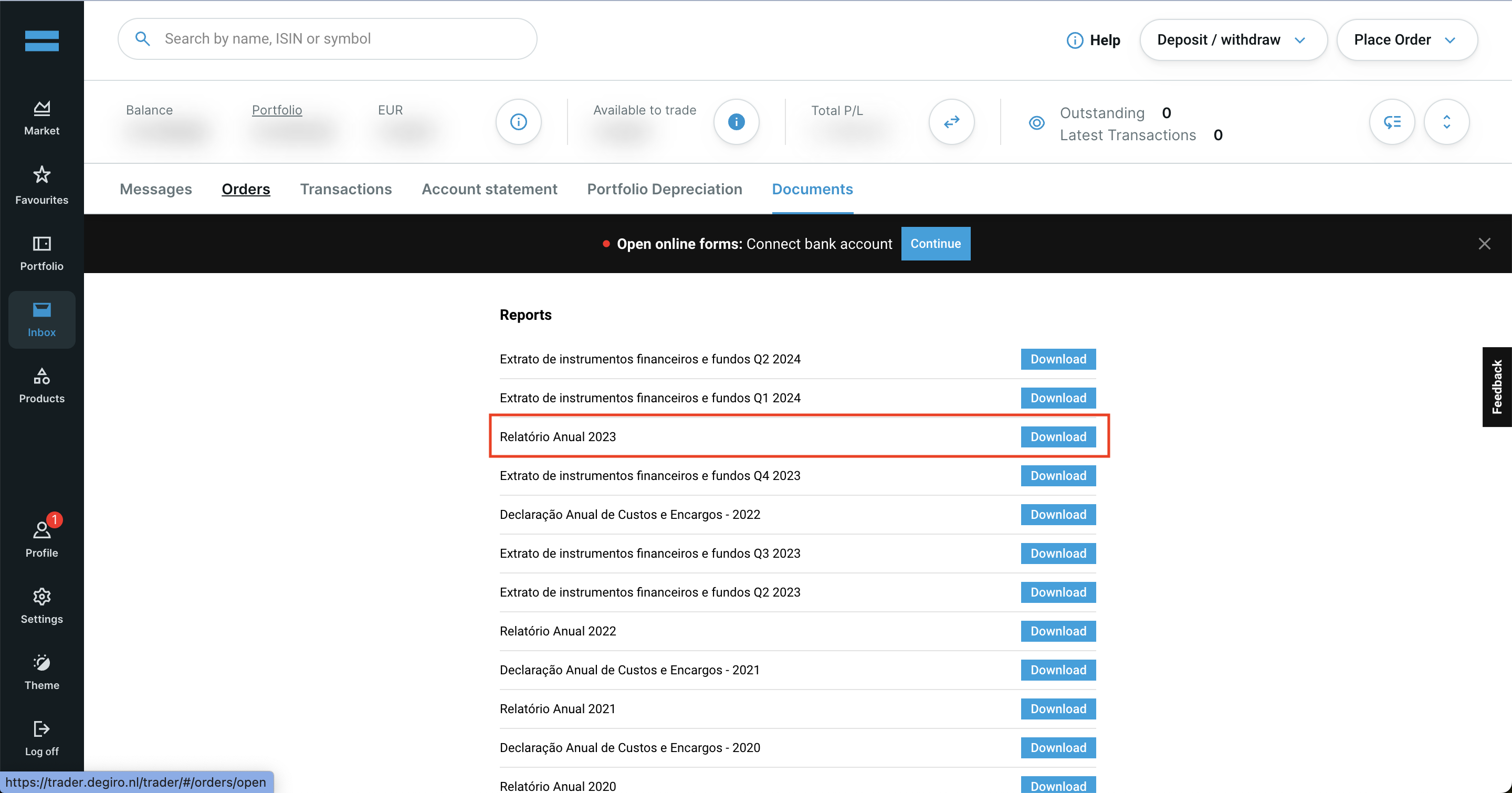

Degiro Annual Report

- 1. Go to the Documents section.

- 2. Look for Annual Report 2025.

- 3. Click on the Download button next to it.

By following these steps, you can ensure you have the correct files needed to use with Tax-wizard.

From here you can upload them to Tax-wizard and have your tax report ready in minutes.

Koliko je res vreden vaš čas?

Upoštevajte vrednost svojega časa in mir, ki ga prinaša zanesljivo in natančno orodje za davčno poročanje

(ni naročnina, brez samodejnega podaljšanja)

Premium

Vse funkcije za Revolut, Degiro, eToro, XTB, Trading212, Interactive Brokers, Freedom24, Lightyear, Trade Republic, Coinbase, Robinhood Crypto,...

- Podpora za vse posrednike in valute

- Samodejni izračun kapitalskih dobičkov

- Poročilo s pridobitvami, realizacijami, dividendami in obrestmi

- Poročilo o odprtih pozicijah in statistika

- Statistika transakcij in dividend

- Izvoz odprtih pozicij v Yahoo Finance

Business

Vse premium funkcije za računovodje, finančne svetovalce, davčne svetovalce ali druge strokovnjake in podjetja, ki želijo uporabljati Tax-Wizard za več strank.

- Podpora za vse posrednike in valute

- Samodejni izračun kapitalskih dobičkov

- Poročilo s pridobitvami, realizacijami, dividendami in obrestmi

- Poročilo o odprtih pozicijah in statistika

- Statistika transakcij in dividend

- Izvoz odprtih pozicij v Yahoo Finance