- Home

- Samodejno izpolni Anexo J

- How to Declare P2P Income for IRS - Tax-Wizard Guide

How to Declare P2P Income for IRS - Tax-Wizard Guide

Complete guide to declare P2P platform income on Portuguese IRS. Step-by-step process with aggregation options and tax optimization tips.

Income declaration from P2P (peer-to-peer) platforms such as Crowdpear, Esketit, and Peerberry can be a straightforward process if you follow the correct instructions. These incomes are considered interest, falling under Category E (Capital Income) of the Portuguese Tax Report, IRS declaration.

Filing Deadline

The deadline for filing the Portuguese Tax Report, IRS declaration, is from April 1 to June 30.

Where to Declare: Anexo J and Anexo E

Since the mentioned P2P platforms do not have headquarters in Portuguese territory, the incomes must be declared in Anexo J. If earned in Portugal, the Anexo to fill would be Anexo E. In the case of incomes earned abroad, the filling is done in Anexo J, table 8-A, using the income code E21 - Interest without withholding tax in Portugal.

Steps for Filling Out Anexo J

1. Access Table 8-A in Anexo J:

- Add Anexo J

- Access Table 8 Capital Income (Category E)

- Fill out in Table 8-A

2. Fill in the Relevant Fields:

- Income Code: E21 - Interest without withholding tax in Portugal (except E22, E23,

E24)

- Gross Income: Indicate the total gross amount of interest received, without any tax

withholding.

- Country of Source: Indicate the country where the P2P platform is headquartered,

using the appropriate code.

- Tax Paid Abroad, In the country of source: If there was tax payment, indicate the

amount.

Practical Example of Filling Out Table 8-A in Anexo J

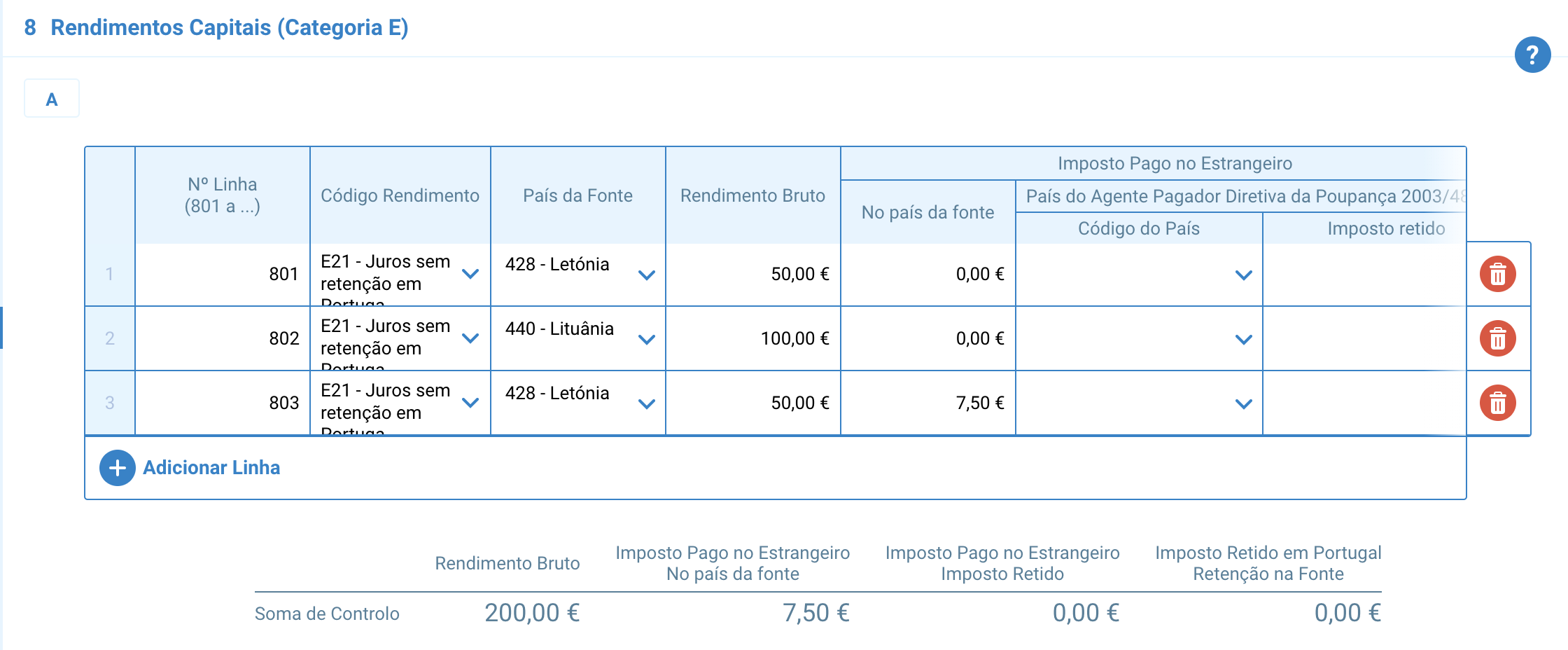

In the following practical example, we assume you received €50 from Esketit, €100 from Peerberry, and

€50 from Crowdpear with €7.5 taxes paid at source.

In Table 8-A of Anexo J, you should fill it out as follows:

And how to save time?

The declaration of capital gains from P2P loan interests, although much simpler than other financial

products, can be a time-consuming and complex process.

To save time and avoid errors, you can choose to use the Tax-Wizard that automates everything for you.

We support various brokers (

Podprti posredniki

) and we also have a simple CSV file import system for unsupported brokers:

Podpiramo vse posrednike

The Anexo J Problem

The Portuguese Tax Authority system does not allow running a simulation with Anexo J filled out. The Tax-Wizard allows you to do so, find out how: Simuliraj Anexo J .

Koliko je res vreden vaš čas?

Upoštevajte vrednost svojega časa in mir, ki ga prinaša zanesljivo in natančno orodje za davčno poročanje

(ni naročnina, brez samodejnega podaljšanja)

Premium

Vse funkcije za Revolut, Degiro, eToro, XTB, Trading212, Interactive Brokers, Freedom24, Lightyear, Trade Republic, Coinbase, Robinhood Crypto,...

- Podpora za vse posrednike in valute

- Samodejni izračun kapitalskih dobičkov

- Poročilo s pridobitvami, realizacijami, dividendami in obrestmi

- Poročilo o odprtih pozicijah in statistika

- Statistika transakcij in dividend

- Izvoz odprtih pozicij v Yahoo Finance

Business

Vse premium funkcije za računovodje, finančne svetovalce, davčne svetovalce ali druge strokovnjake in podjetja, ki želijo uporabljati Tax-Wizard za več strank.

- Podpora za vse posrednike in valute

- Samodejni izračun kapitalskih dobičkov

- Poročilo s pridobitvami, realizacijami, dividendami in obrestmi

- Poročilo o odprtih pozicijah in statistika

- Statistika transakcij in dividend

- Izvoz odprtih pozicij v Yahoo Finance