- Home

- Supported Brokers

- Revolut

How to Fill Your Revolut Taxes in 2025 - Tax-Wizard

Easily calculate your Revolut investment taxes with Tax-Wizard. Automate your Revolut tax reporting and save time on your tax declaration.

This guide is designed to assist anyone who have investments on Revolut and is seeking clarity on how to pay taxes. The information provided here should be useful when calculating your Revolut taxes. However, it’s important to supplement this guide with the tax regulations specific to your country.

If you need to calculate taxes for your Revolut investments, either on their Brokerage Account, Crypto investments, Flexible Cash Funds, or Robo-Advisor, you’re in the right place! There are several ways to do this, such as calculating taxes manually in Excel, using an automated tax tool like Tax-wizard, or hiring a tax professional. Your choice will often depend on your budget and preferences.

How to export your Revolut history

- 1. Revolut Invest (Brokerage Account)

- 2. Revolut Robo-Advisor

- 3. Revolut Crypto

- 4. Revolut Flexible Cash Funds

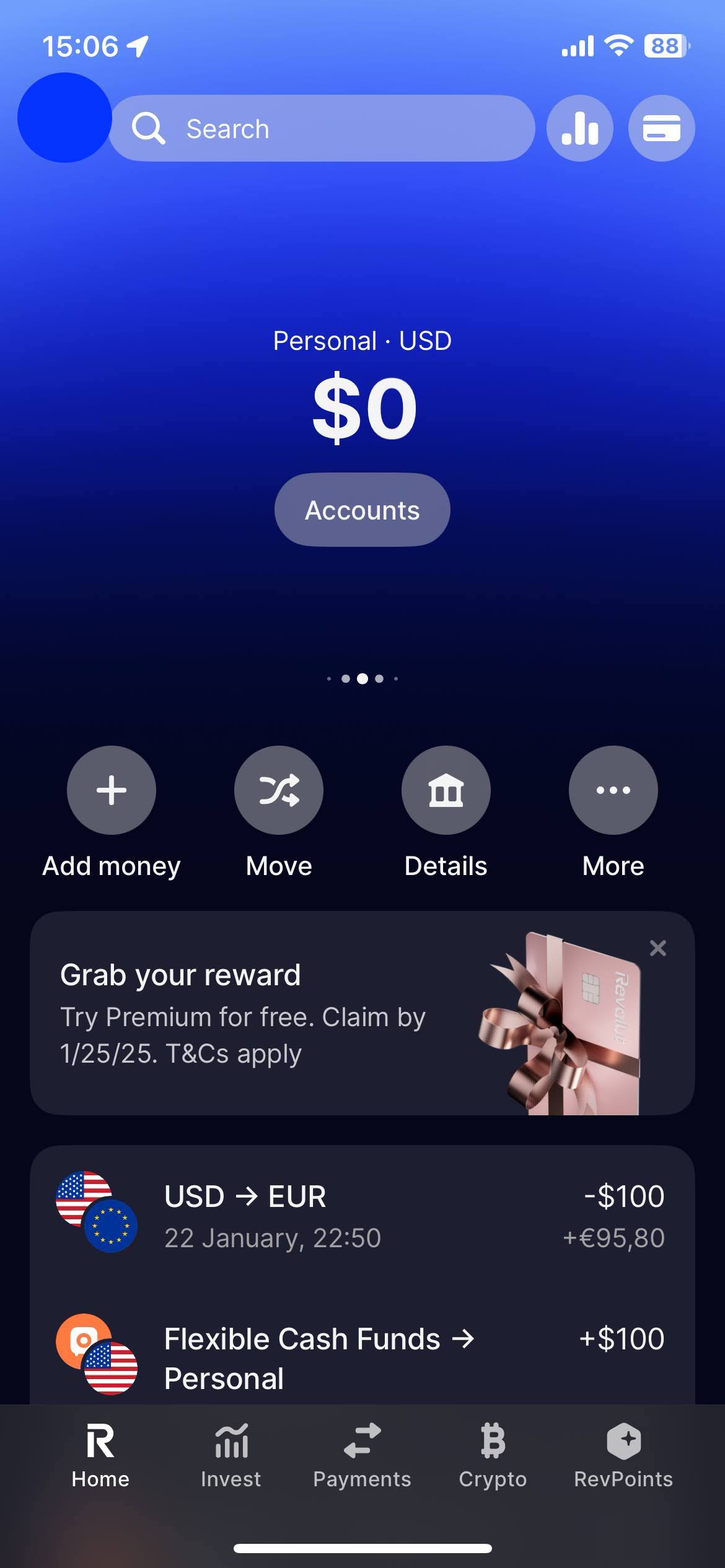

Start by Login on your Revolut mobile app.

Revolut Invest (Brokerage Account)

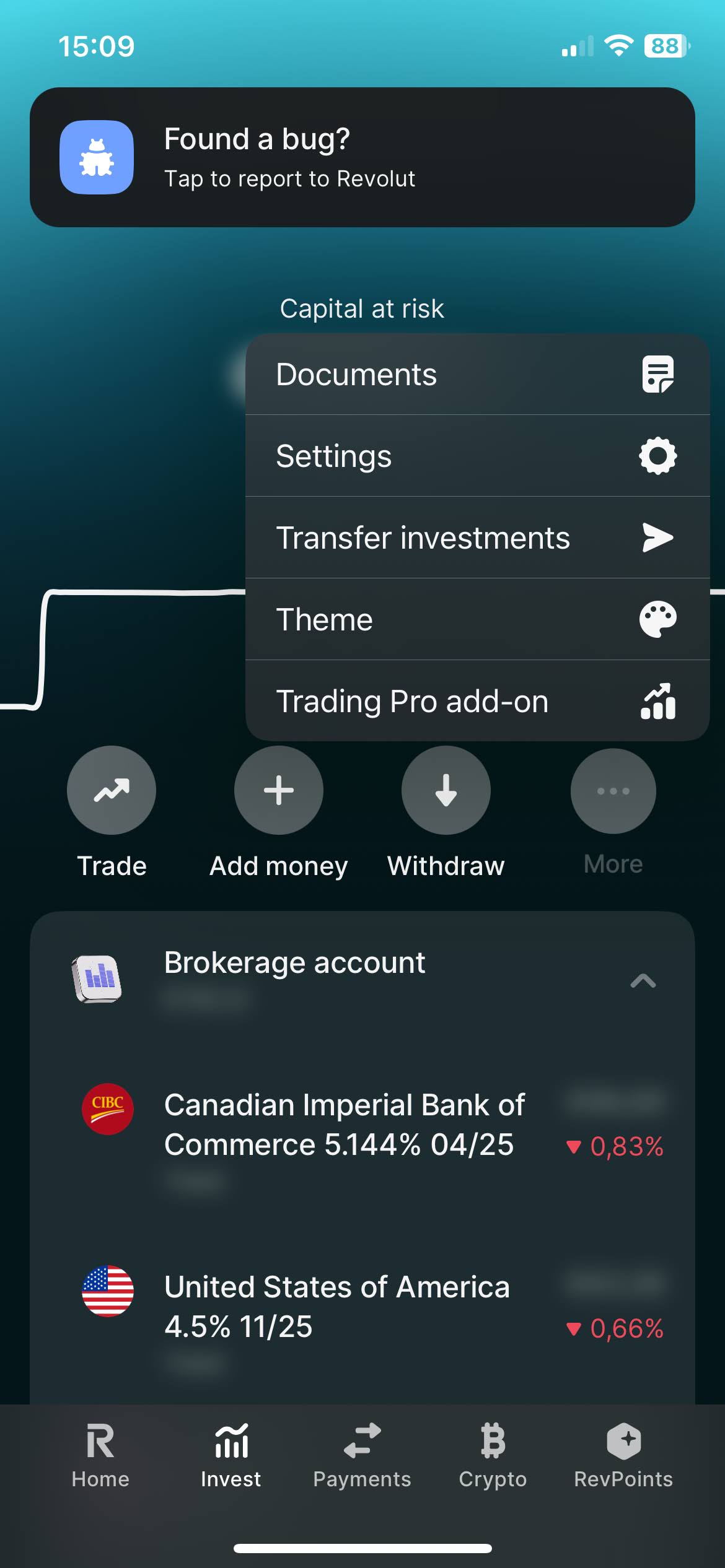

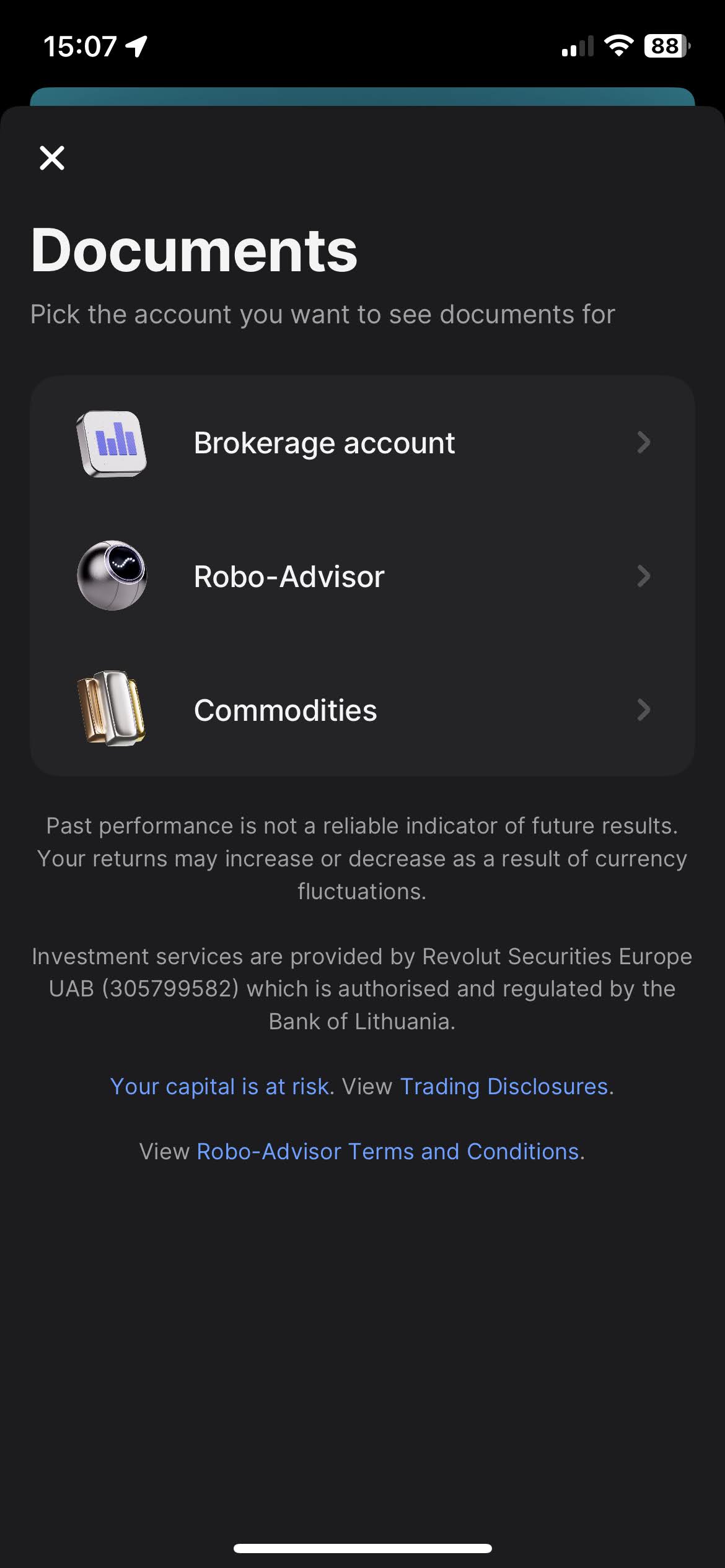

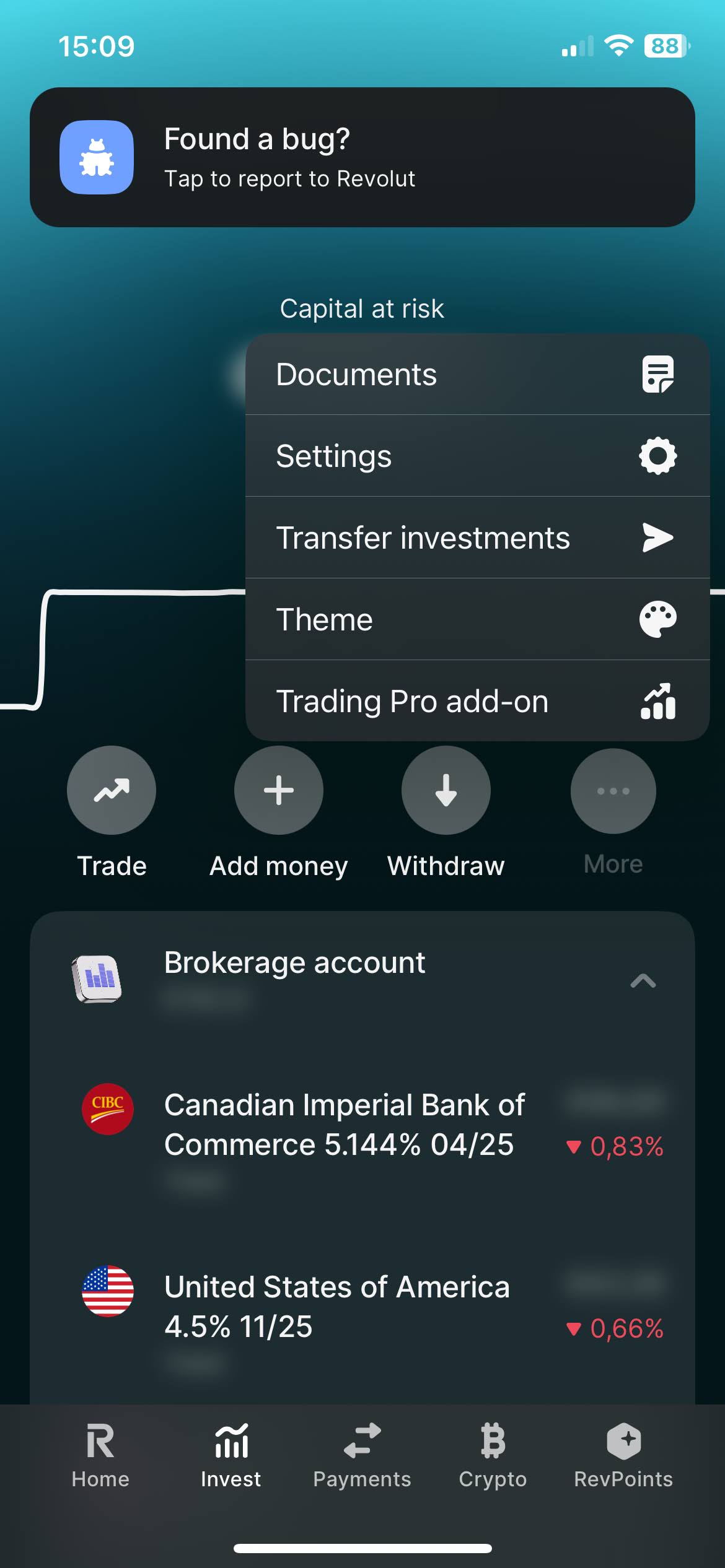

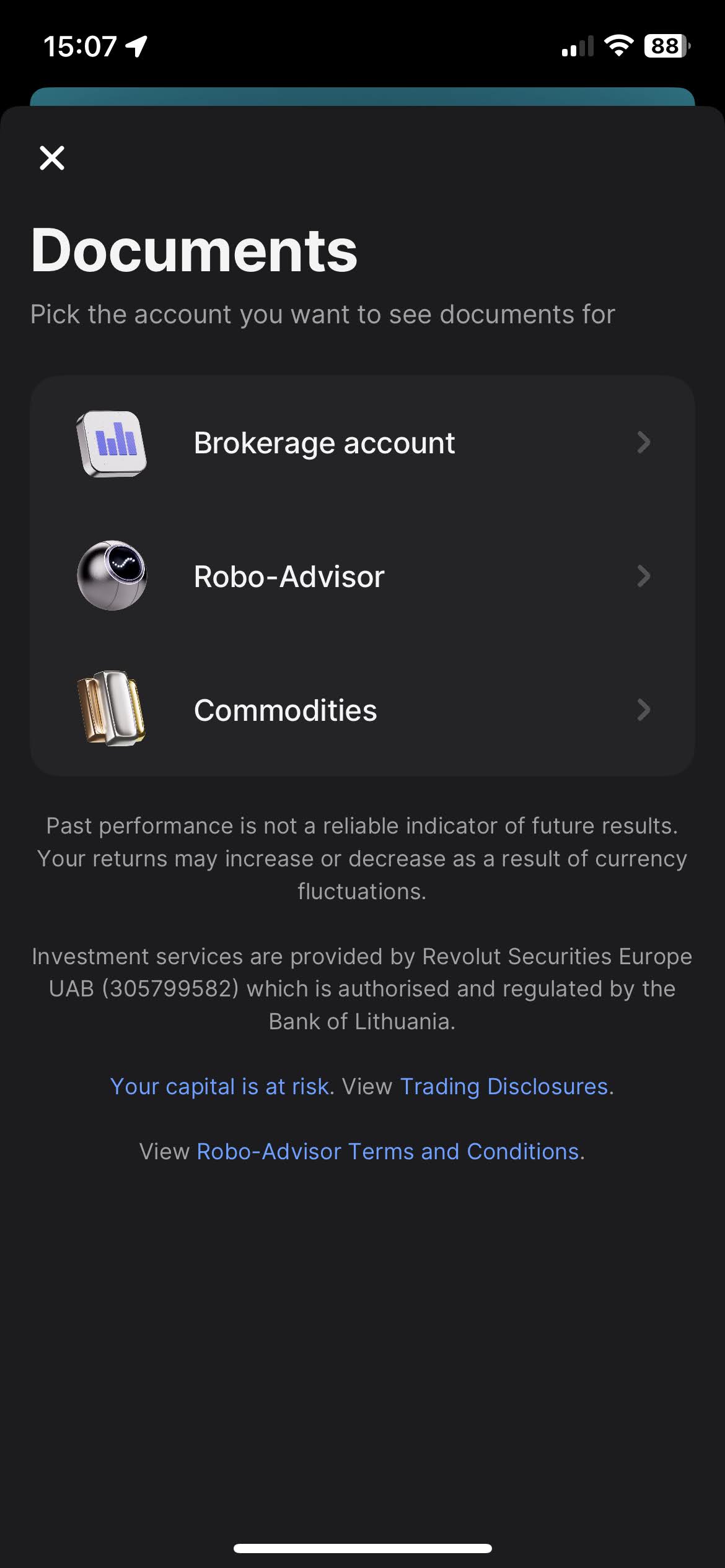

Select on your Revolut app the "Invest" tab. And open the menu by clicking on the three dots, there you'll find the "Documents" option. Select "Brokerage Account".

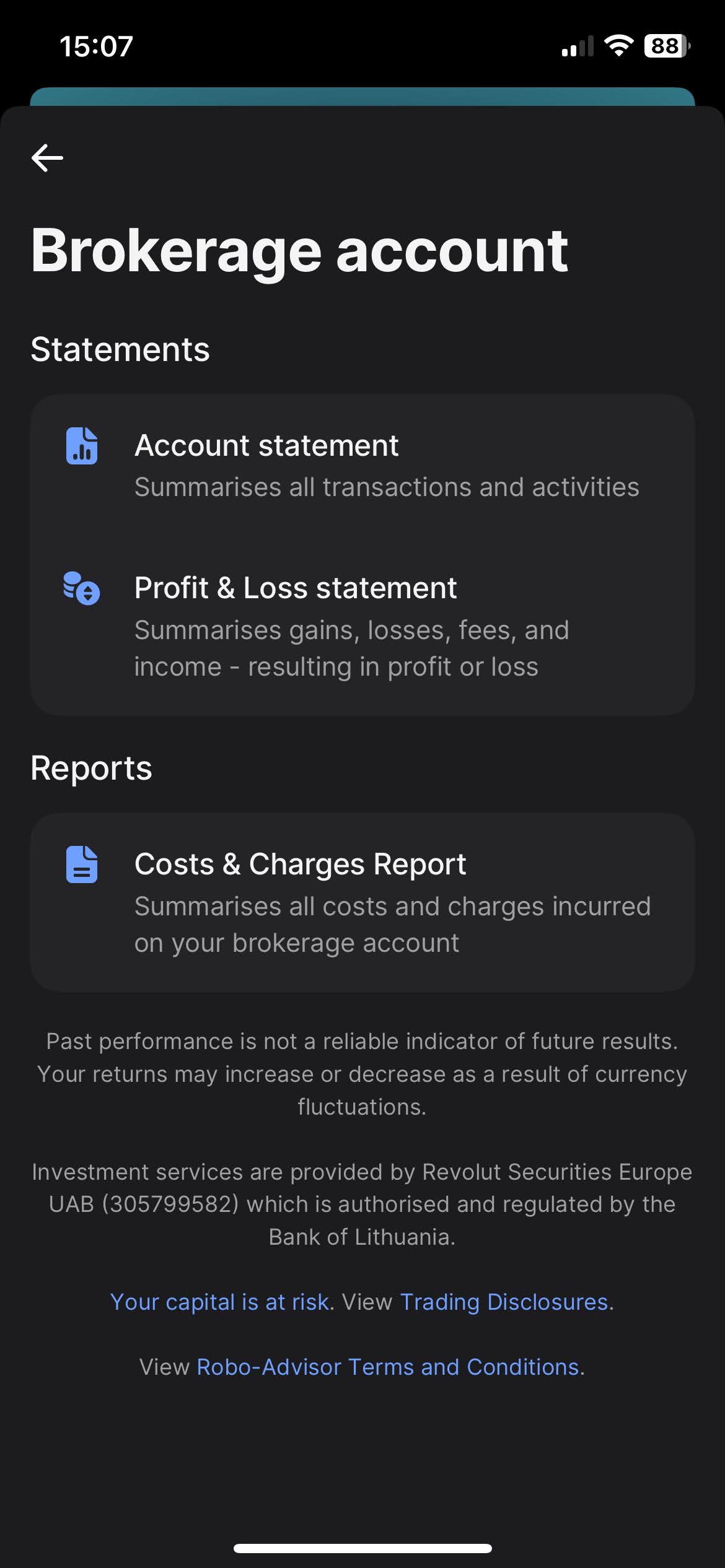

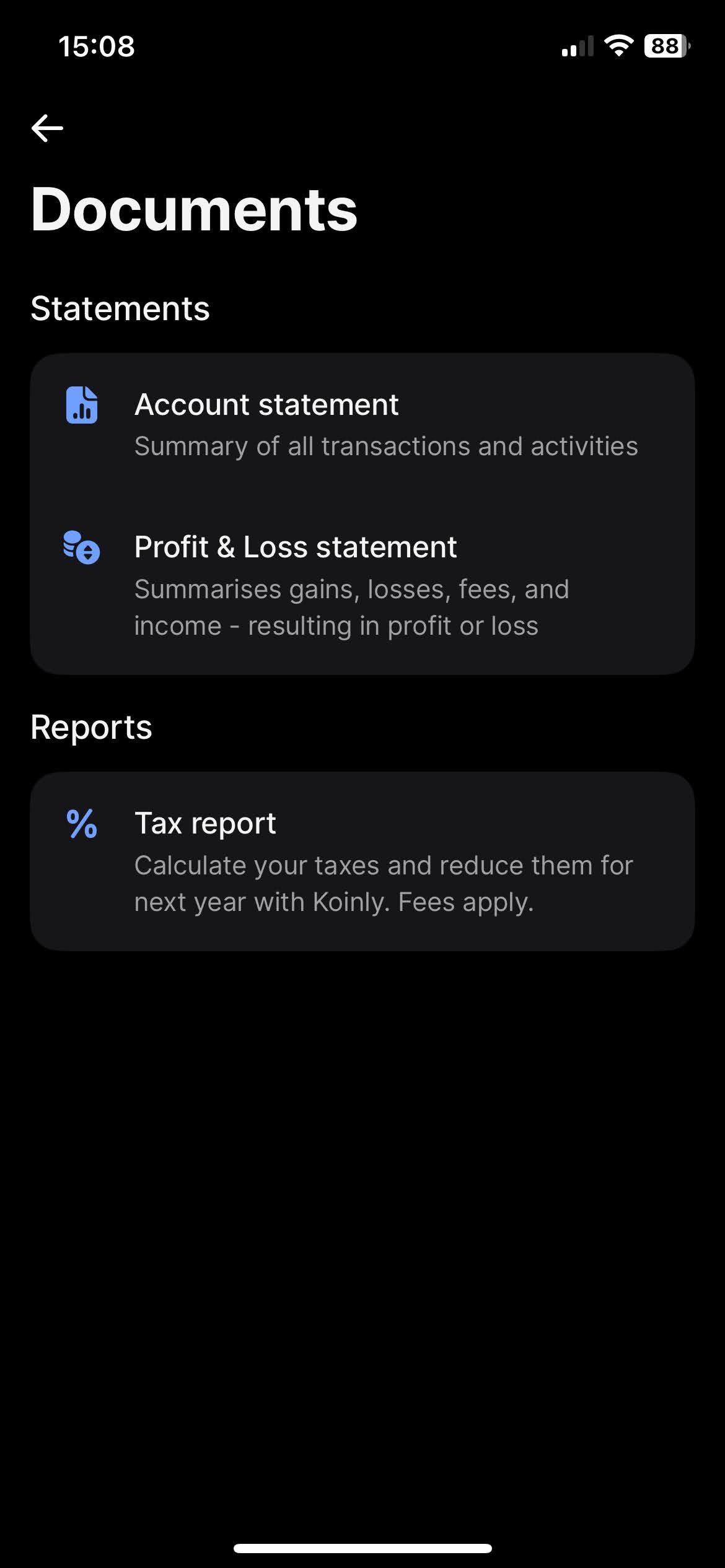

When you click on "Brokerage Account", you'll find the option to download your statements. Revolut offers a variety of types of statements, such as "Account Statement", "Profit & Loss Statements", and "Cost & Charges Report". The most complete one, and the one we're after is the "Account Statement".

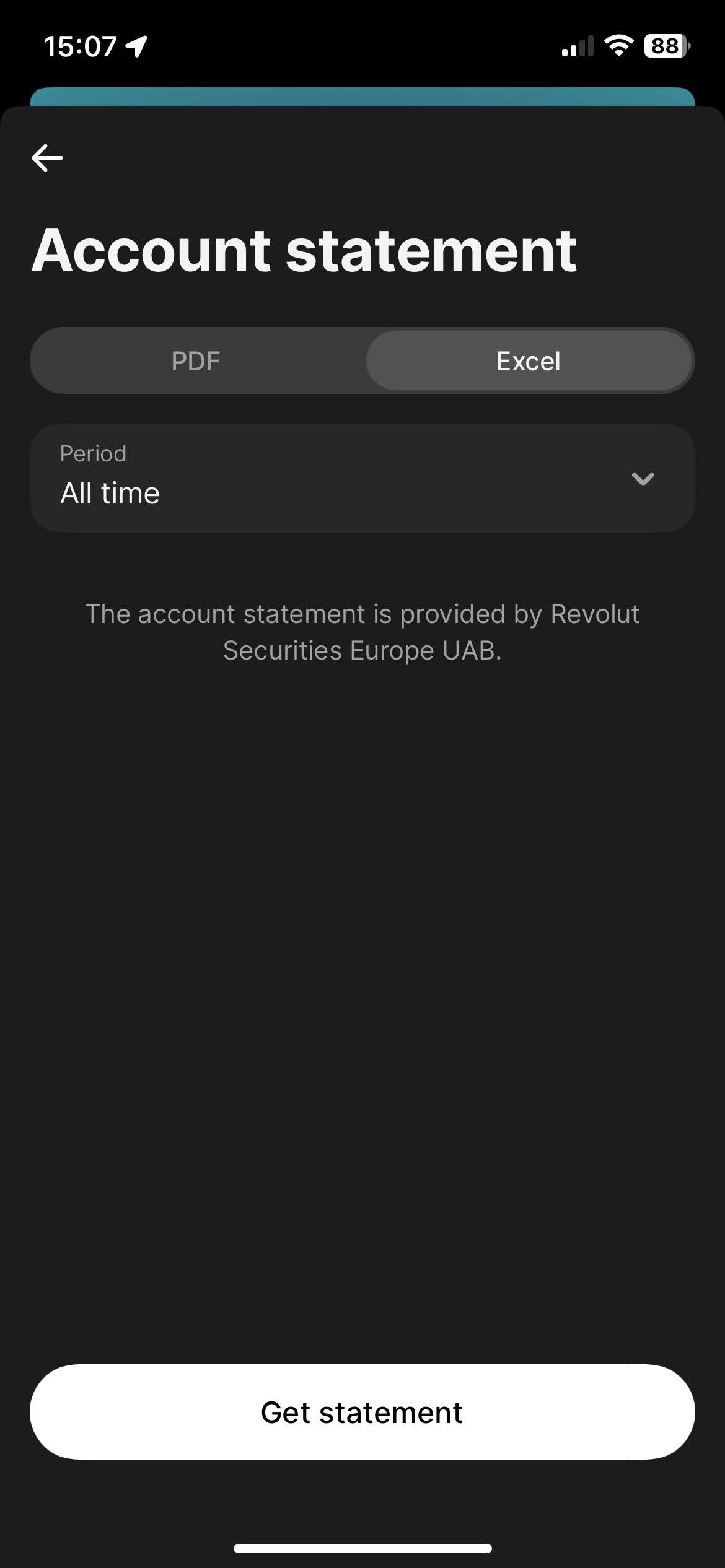

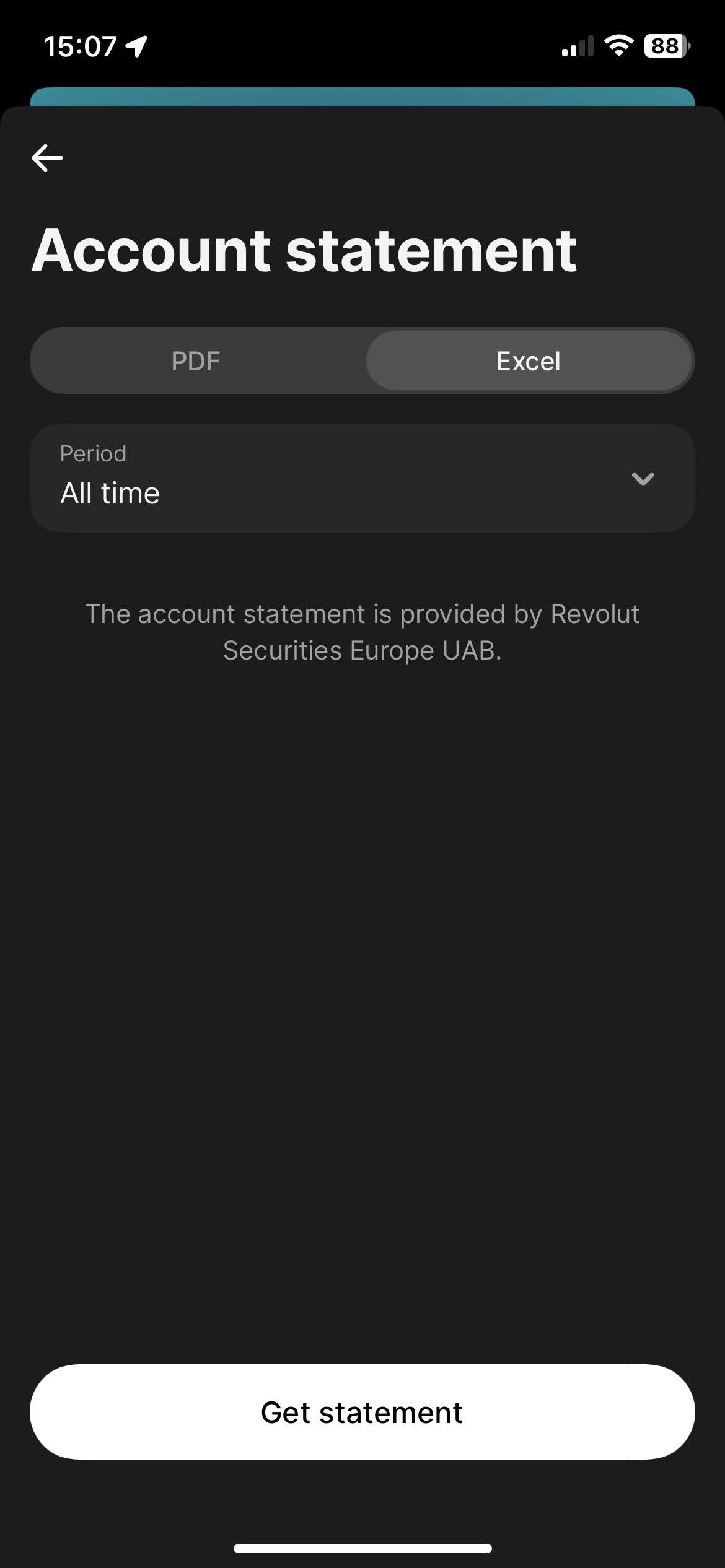

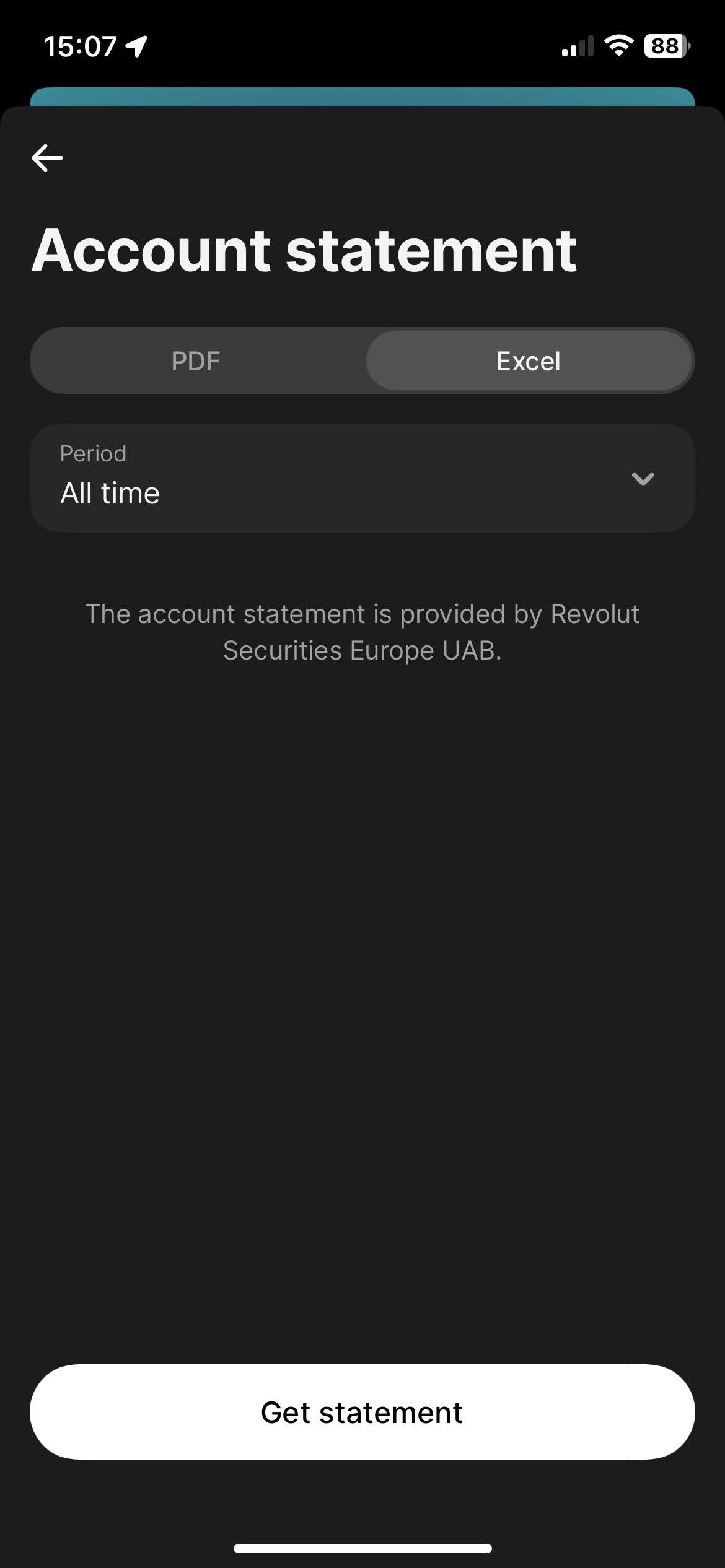

To download the Account Statement, select the "Excel" tab, for the period select "All time", and click on the "Get statement" button.

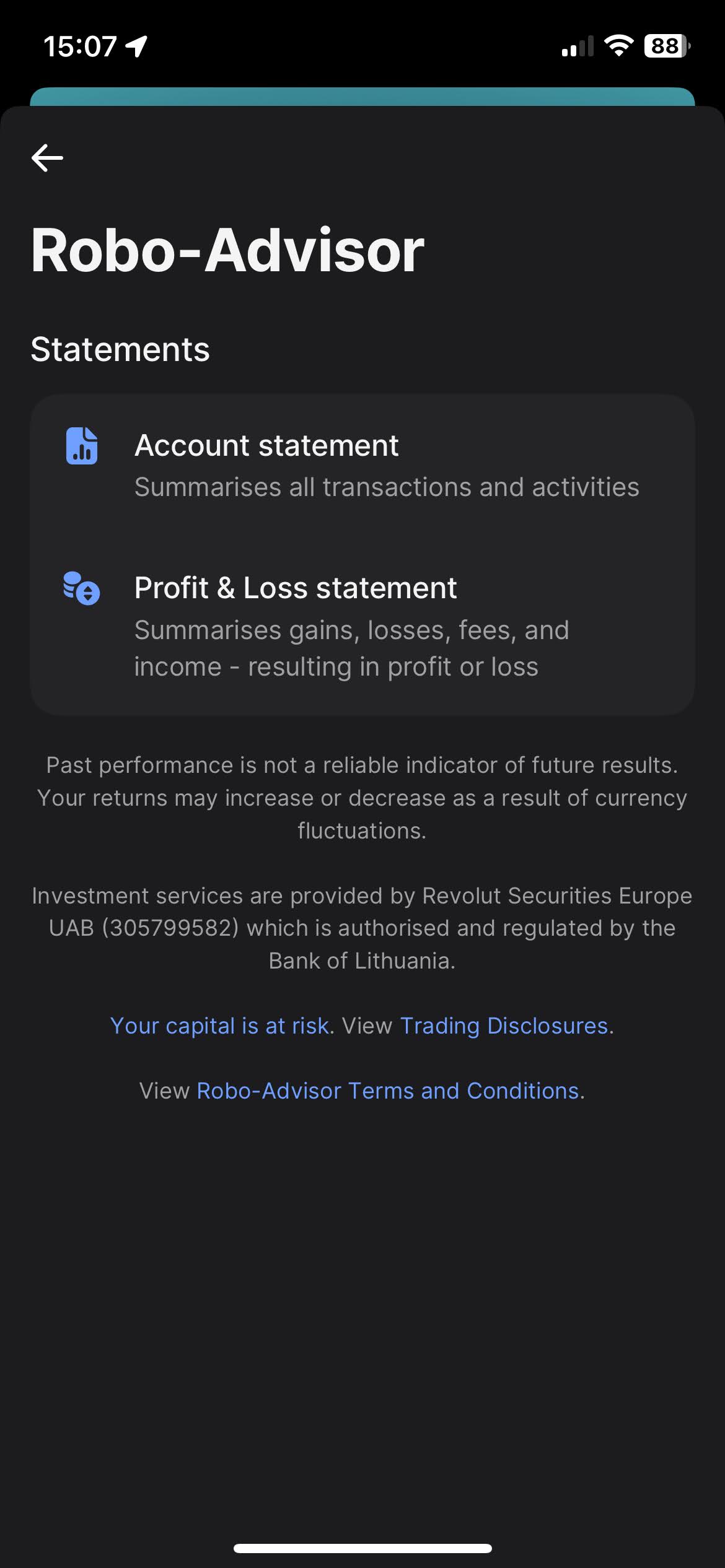

Revolut Robo-Advisor

The process for Robo-Advisor is very similar to the Revolut Invest (Brokerage Account).

Select on your Revolut app the "Invest" tab. And open the menu by clicking on

the

three dots, there you'll find the "Documents" option. Select "Robo-Advisor".

When you click on "Robo-Advisor", you'll find the option to download your statements. Revolut offers a variety of types of statements, such as "Account Statement" and "Profit & Loss Statements". The most complete one, and the one we're after is the "Account Statement".

To download the Account Statement, select the "Excel" tab, for the period select "All time", and click on the "Get statement" button.

Revolut Crypto

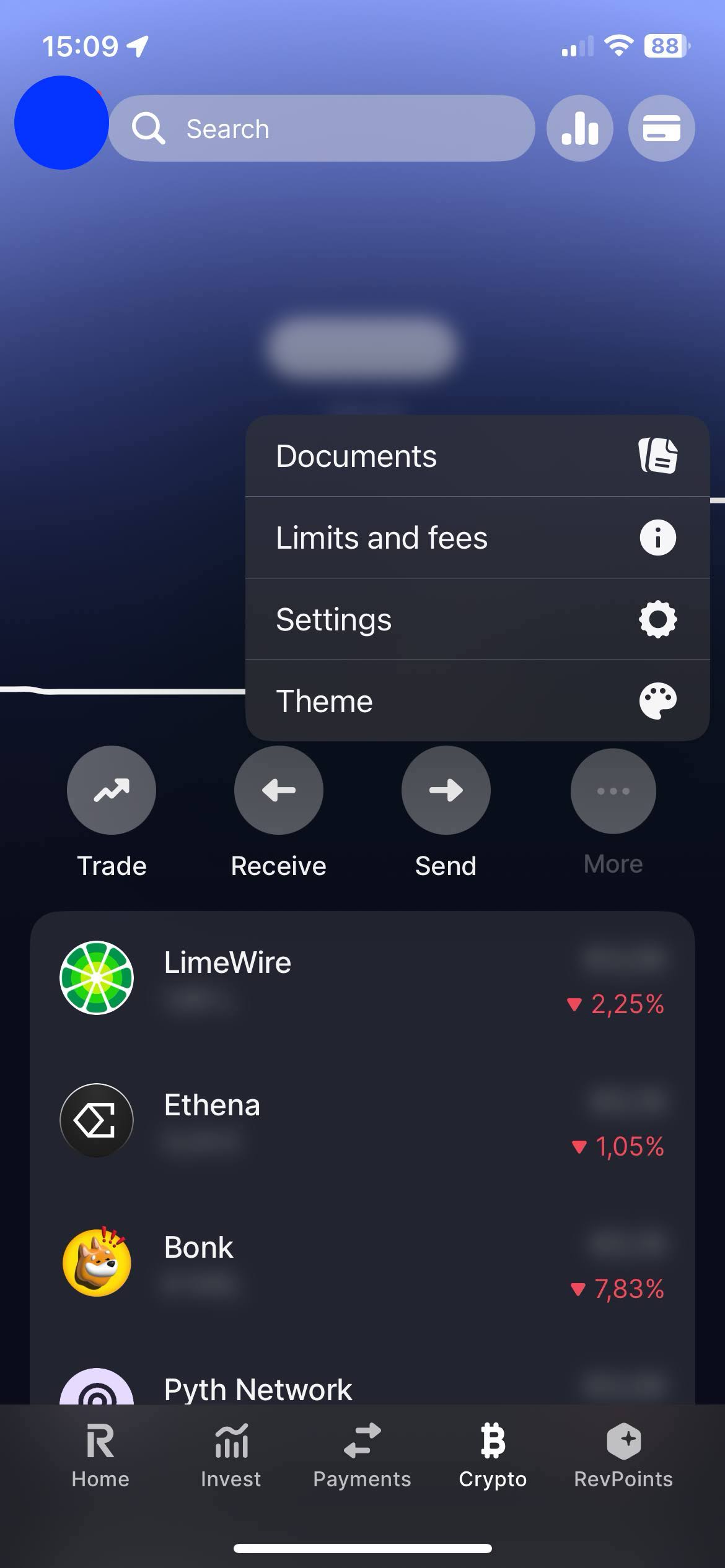

Select on your Revolut app the "Crypto" tab. And open the menu by clicking on the three dots, there you'll find the "Documents" option.

When you click on "Documents", you'll find the option to download your statements. Revolut offers a variety of types of statements, such as "Account Statement" and "Profit & Loss Statements". The most complete one, and the one we're after is the "Account Statement".

To download the "Account Statement", select the "Excel" tab, for the period select "All time", and click on the "Get statement" button.

Revolut Flexible Cash Funds

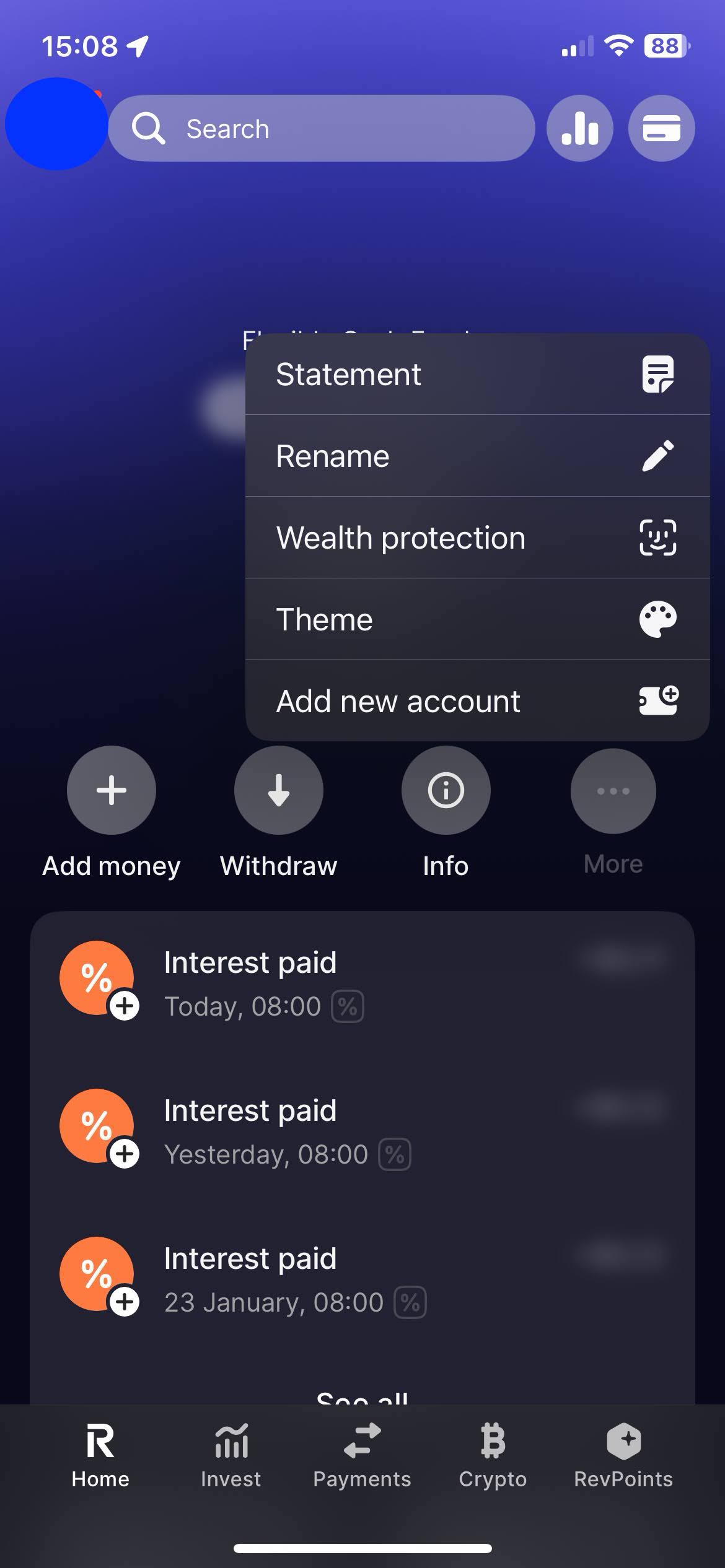

On your Revolut app on the "Home" tab slide your accounts until you find your "Flexible Cash Funds". Open the menu by clicking on the three dots, there you'll find the "Statement" option.

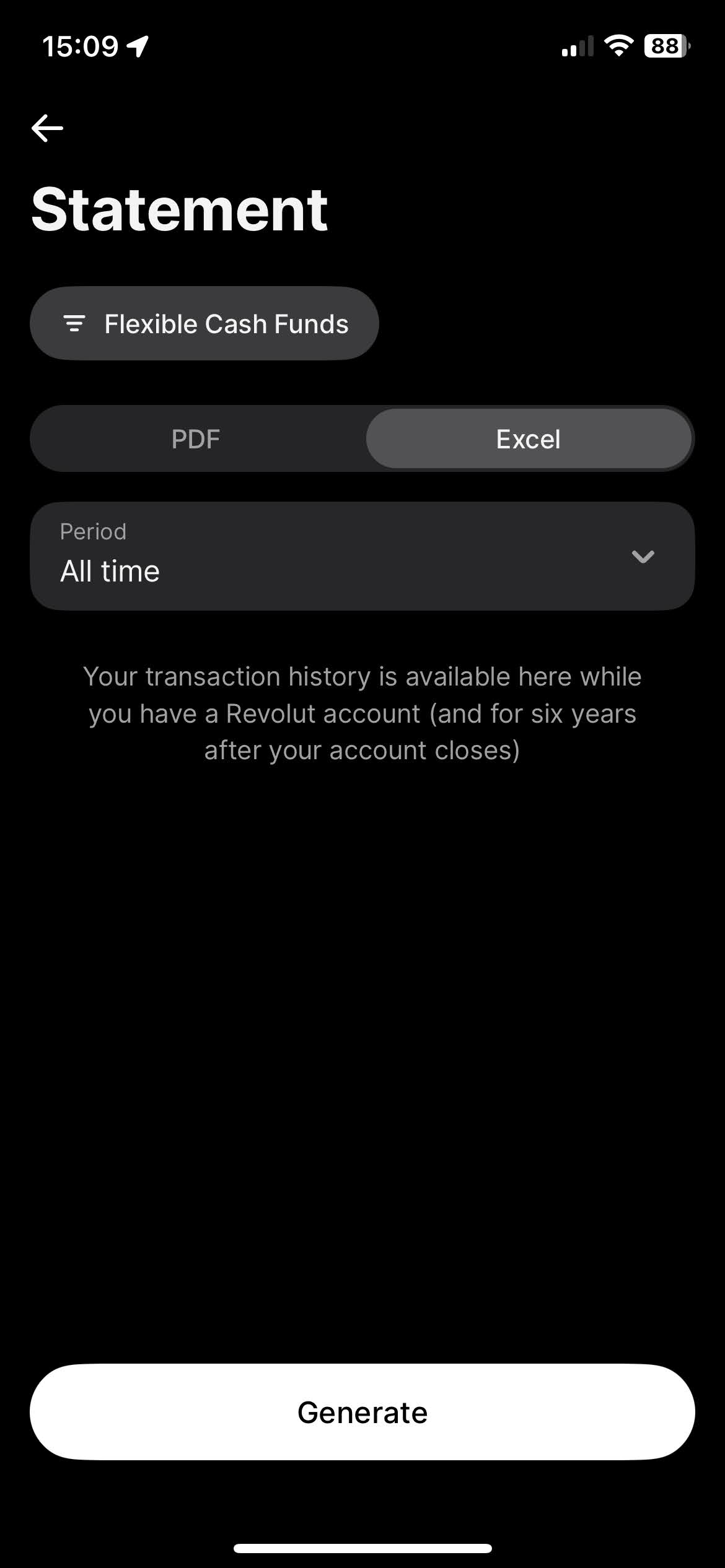

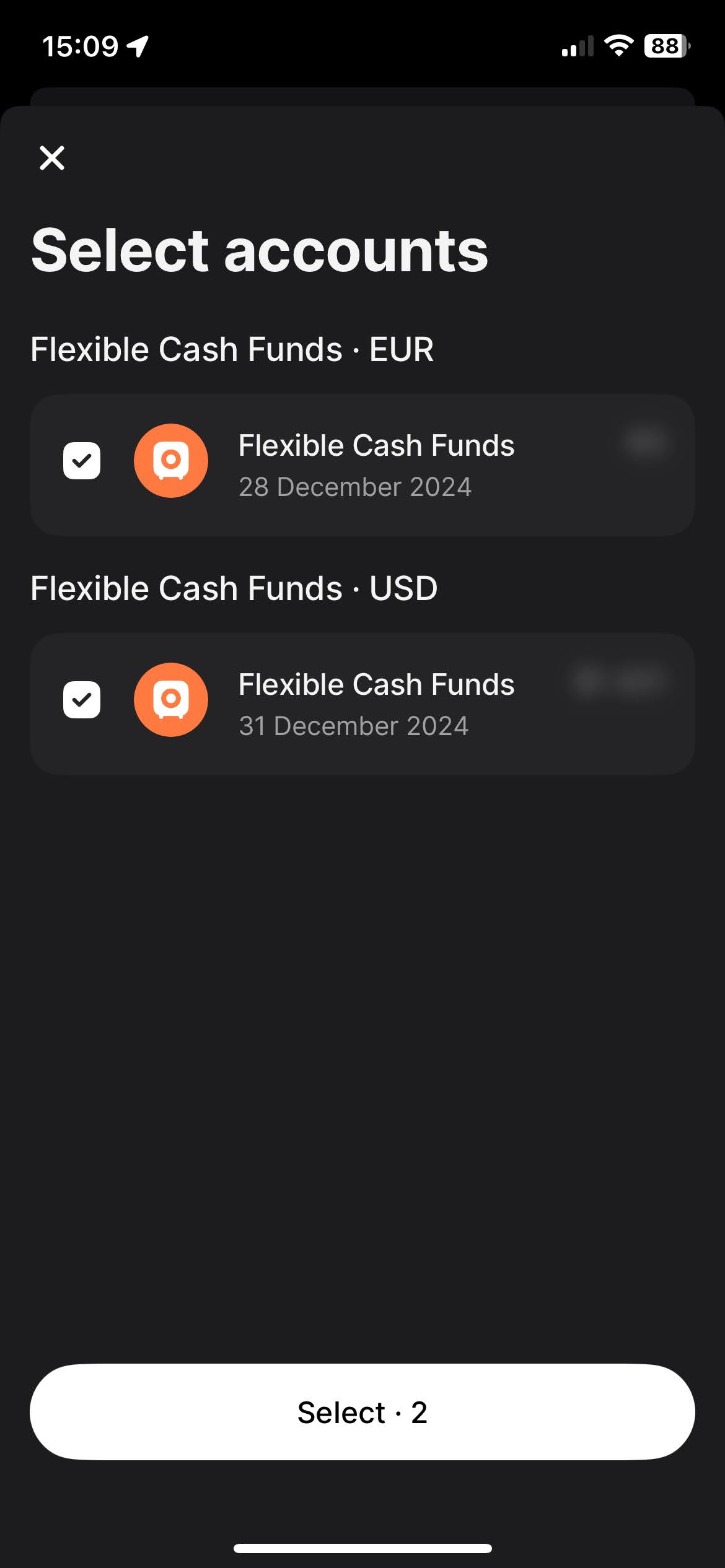

It is possible to have Flexible Cash Funds in different currencies. Revolut has the option to generate a statement containing all different Flexible Cash Funds. For that on the "Statement" page click on the top menu "Flexible Cash Funds" and select all accounts.

To download the "Account Statement", select the "Excel" tab, for the period select "All time", and click on the "Get statement" button.

By following these steps, you can ensure you have the correct files needed to use with Tax-wizard.

From here you can upload them to Tax-wizard and have your tax report ready in minutes.

How much is your time really worth?

Consider the value of your time and the peace of mind that comes with having a reliable and accurate tool to handle your tax reporting

(not a subscription, no auto renewal)

Premium

All features, for Revolut, Degiro, eToro, XTB, Trading212, Interactive Brokers, Freedom24, Lightyear, Trade Republic, Coinbase, Robinhood Crypto,...

- Support for all brokers and currencies

- Automatic calculation of capital gains

- Report with Acquisitions, Realizations, Dividends, and Interest

- Open positions report and statistics

- Transaction and dividends statistics

- Export Open Positions to Yahoo Finance

Business

All premium features, for accountants, financial advisors, tax consultants, or other professionals and companies wanting to use Tax-Wizard for multiple clients.

- Support for all brokers and currencies

- Automatic calculation of capital gains

- Report with Acquisitions, Realizations, Dividends, and Interest

- Open positions report and statistics

- Transaction and dividends statistics

- Export Open Positions to Yahoo Finance