- Home

- Portuguese IRS Declaration Guide - Tax-Wizard

Portuguese IRS Declaration Guide - Tax-Wizard

Complete guide to calculate capital gains and dividends for Portuguese IRS. Automatic filling of Anexos E, G, G1, and J with Tax-Wizard.

📚 Quer aprender primeiro sobre as regras fiscais portuguesas? Consulte o nosso Guia Fiscal Portugal 2025 - IRS, Mais-Valias, Crypto e Anexo J.

Tax-Wizard is the solution that allows you to simplify the completion of your IRS declaration by

automating the entire process.

You can use Tax-Wizard to transfer information from Revolut, Degiro,

eToro, XTB, Trading212, Interactive Brokers, and Lightyear statements directly to your IRS

declaration (Anexo E, Anexo G, Anexo J).

To do this, you just need to fill out your IRS declaration on the Portal das Finanças as usual,

without the need to complete Anexo E, Anexo G, Anexo G1, and Anexo J, just attaching them to the Declaration.

Declaration with more than one Taxpayer with Investments:

To complete the joint declaration, follow these steps and include Anexo J for each taxpayer

investor.

Begin by submitting the IRS declaration, exported from "Portal das Finanças", along with the

corresponding brokers' statements for the first taxpayer to Tax-Wizard.

Next, submit to Tax-Wizard for the second taxpayer using the IRS declaration exported from the

Tax-Wizard of the first taxpayer, along with the second taxpayer's brokers' statements.

Repeat this process for each taxpayer involved. The final declaration will be the last submission.

Ensure the Tax-Wizard option "Allow existing data in Annexes E, G, G1, and J" is always selected.

Additionally, accurately fill in the "Fiscal Number (NIF) for filling Annexes E, G, G1, and J" field

under "Advanced Settings".

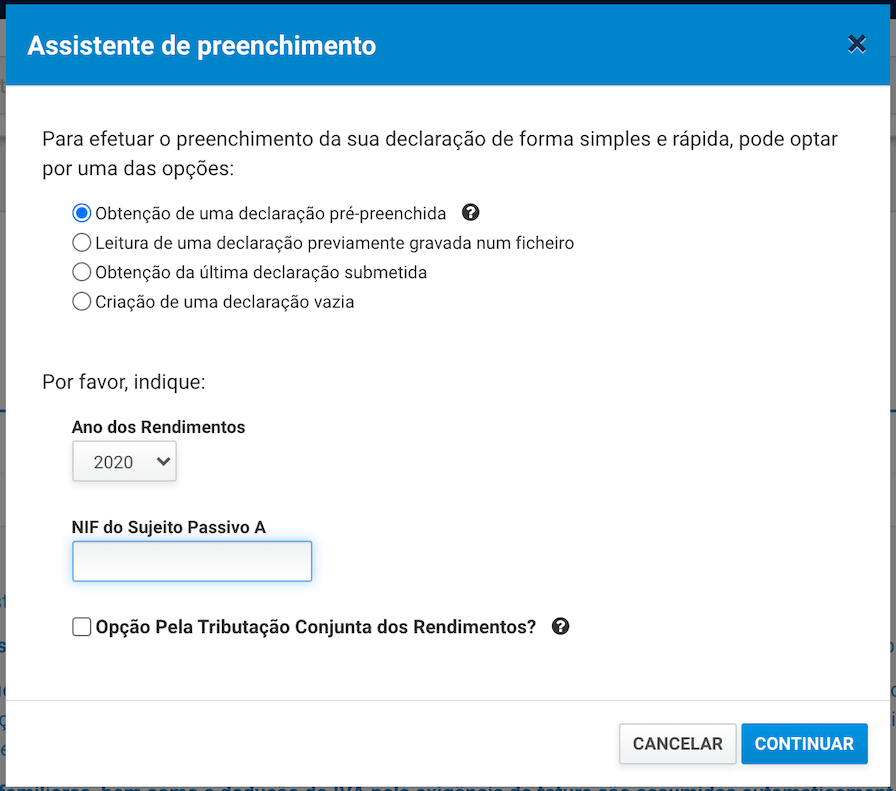

Step 1: Start with a pre-filled IRS declaration.

After filling out all fields - ensure it is valid. Ideally, you should be able to simulate your IRS before the next step.

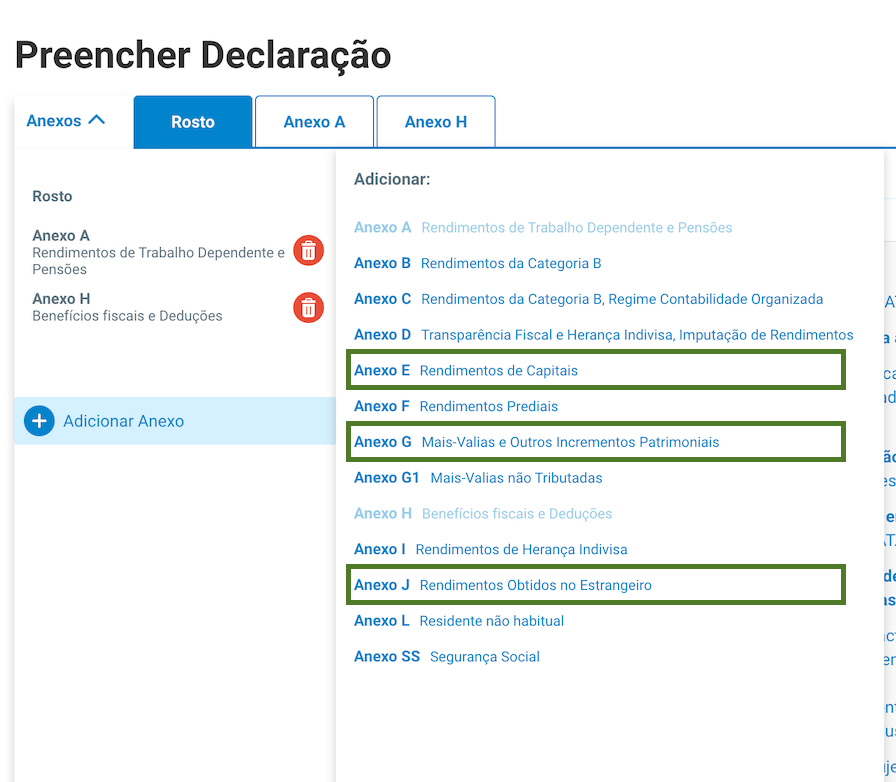

Step 2: Add Anexo E, Anexo G, Anexo G1, and Anexo J

In the declaration, add "Anexo J - Rendimentos Obtidos no Estrangeiro".

Leave all fields of Anexo J unfilled. Follow the same steps for Anexos E and G.

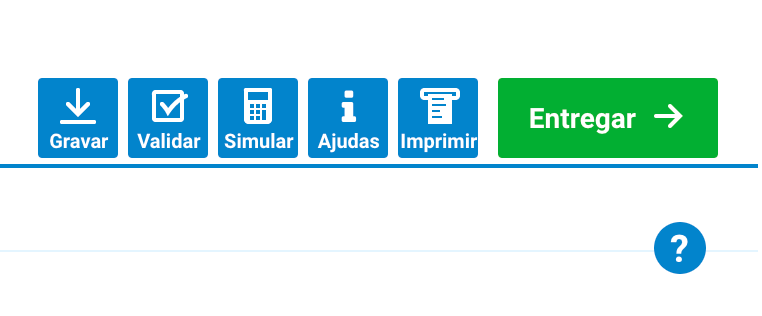

Step 3: Export the IRS Declaration file

In the upper right corner, you'll find an option to export the IRS Declaration file (XML format)

using the "Save" option.

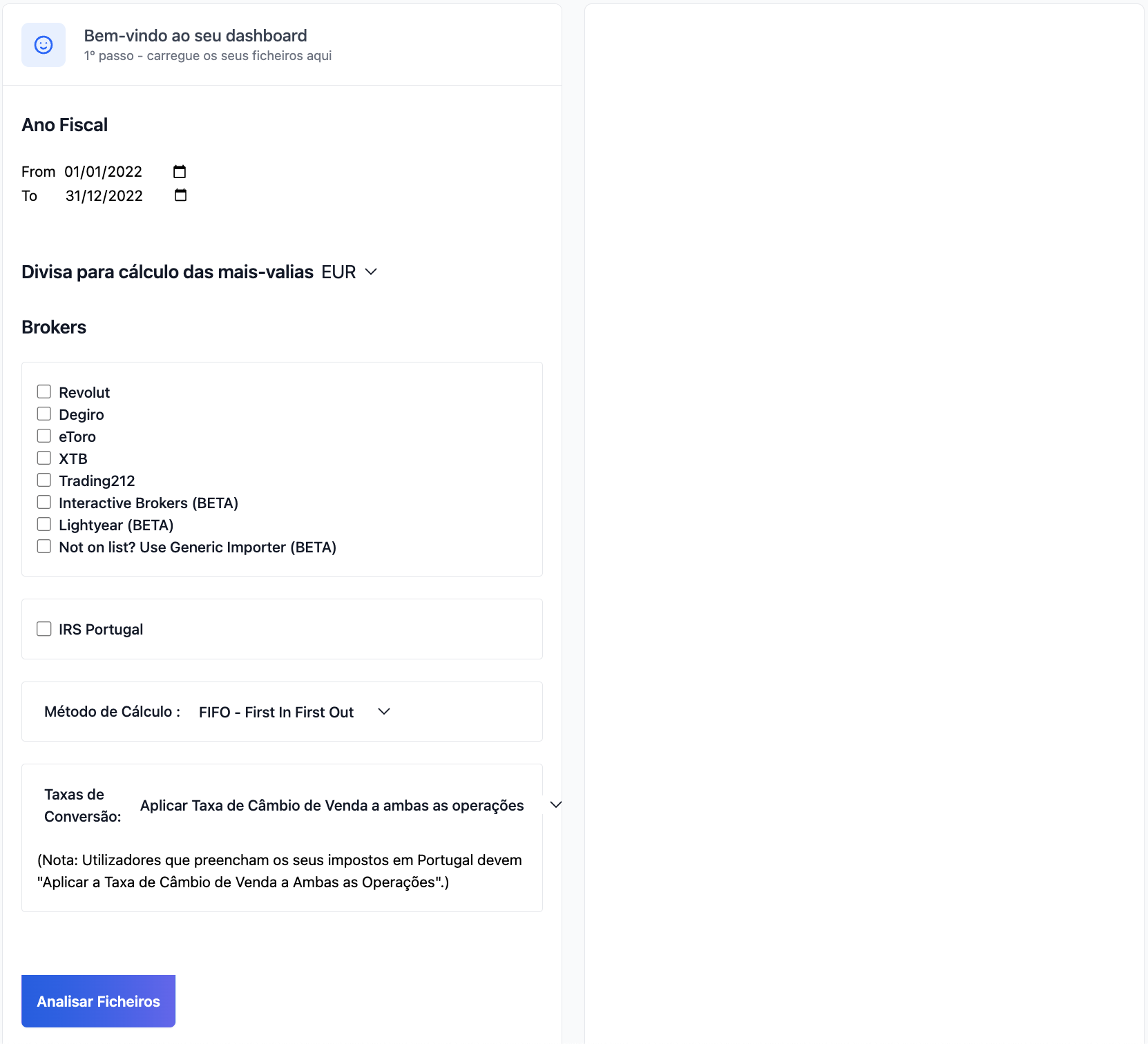

Step 4: Automatically Generate the IRS Declaration

In the Tax-Wizard tool, upload the IRS Declaration file along with the Statements exported directly

from the supported brokers, including Revolut, Degiro, eToro, XTB, Trading212, Interactive Brokers,

and Lightyear.

Click on 'analyze files', then you'll have the option to download the Declaration

file with the Anexos filled (Anexo E, Anexo G, Anexo G1, and J).

(don't worry about the screenshot language, we've got you covered and everything is translated)

Step 5: Review and Download

Access all information extracted from the files submitted directly on your Dashboard and download the various summary files generated by Tax-Wizard.

In these files, you'll find all information related to processed transactions, converted into any of the supported currencies, and with data related to capital gains.

Access all summarized data on your received dividends and interest.

We also provide a file with information regarding your open positions, such as average values, quantity. This file allows you to have an overview of your portfolio and act accordingly. Learn more about Tax-Loss Harvesting .

Regarding open positions, we provide a file compatible with Yahoo Finance where you can import your portfolio through a simple upload.

You can also download your IRS Declaration file to submit to the Portuguese Tax Authority.

If necessary, consult a professional to verify the accuracy of the reports before submitting your tax declaration.

Step 6: Submit to the Tax Authority

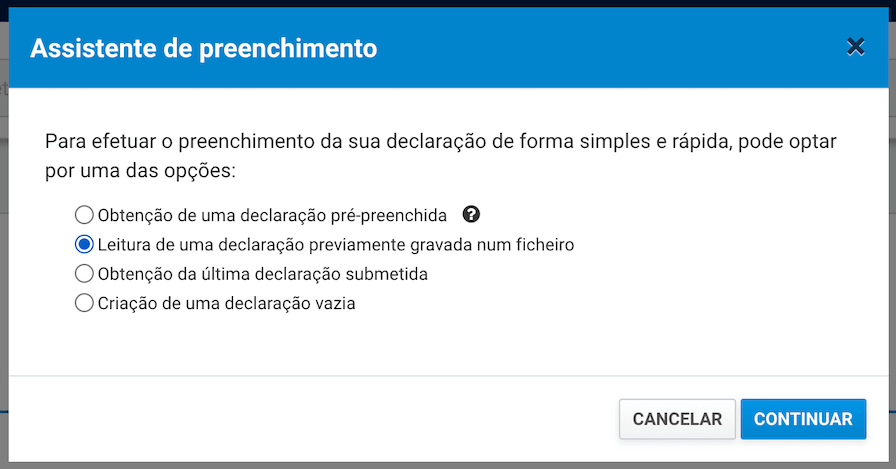

After downloading the automatically filled IRS Declaration file (XML), access the Portal das Finanças again, just as you would to fill out an IRS Declaration.

Upload the IRS declaration extracted from Tax-Wizard, start filling out a declaration, and use the "Leitura de uma declaração previamente gravada num ficheiro" option.

Before submitting, validate all data again to ensure that your IRS declaration is correctly filled out and free from calculation errors.

The Anexo J Problem

The Portuguese Tax Authority system does not allow running a simulation with Anexo J filled out. The Tax-Wizard allows you to do so, find out how: Simulate Anexo J .

How much is your time really worth?

Consider the value of your time and the peace of mind that comes with having a reliable and accurate tool to handle your tax reporting

(not a subscription, no auto renewal)

Premium

All features, for Revolut, Degiro, eToro, XTB, Trading212, Interactive Brokers, Freedom24, Lightyear, Trade Republic, Coinbase, Robinhood Crypto,...

- Support for all brokers and currencies

- Automatic calculation of capital gains

- Report with Acquisitions, Realizations, Dividends, and Interest

- Open positions report and statistics

- Transaction and dividends statistics

- Export Open Positions to Yahoo Finance

Business

All premium features, for accountants, financial advisors, tax consultants, or other professionals and companies wanting to use Tax-Wizard for multiple clients.

- Support for all brokers and currencies

- Automatic calculation of capital gains

- Report with Acquisitions, Realizations, Dividends, and Interest

- Open positions report and statistics

- Transaction and dividends statistics

- Export Open Positions to Yahoo Finance