- Home

- Autofill Anexo J

- Law 31/2024 - Portugal Long-Term Tax Reduction

Law 31/2024 - Portugal Long-Term Tax Reduction

Up to 30% tax reduction for long-term investments in Portugal. Understand Law 31/2024 and how to benefit with Tax-Wizard.

Law No. 31/2024 of June 28 introduced significant changes to investment taxation in Portugal, aiming to encourage long-term financial asset retention.

Key changes:

- - Assets held between 2 and 5 years: 10% reduction in the tax rate.

- - Assets held between 5 and 8 years: 20% reduction.

- - Assets held for more than 8 years: 30% reduction.

Source: Lei n.º 31/2024, de 28 de junho

Considering the standard capital gains tax rate is 28%, the maximum reduction results in an effective rate of 19.6% for assets held for more than eight years.

Benefits for investors:

Holding investments for longer periods allows investors to benefit from lower tax burdens, increasing net returns and promoting market stability.

Application of the new regime:

The reductions automatically apply to capital gains realized after the respective asset retention periods. These measures aim to foster long-term savings and investment in the Portuguese capital market.

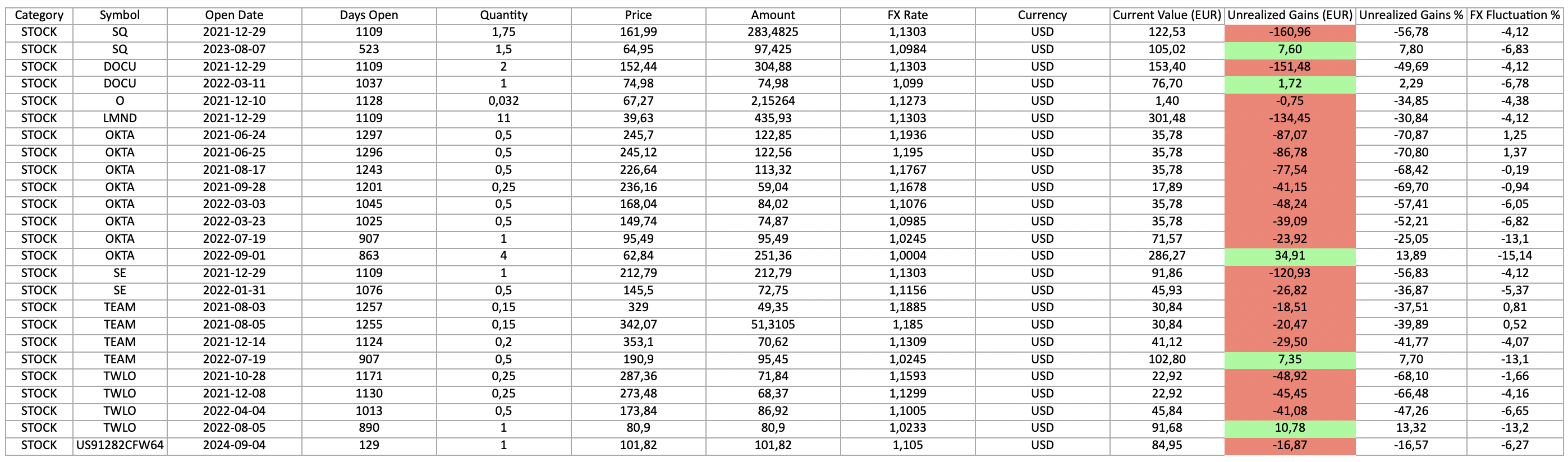

Open Positions Report

Tax-Wizard provides a detailed open positions report that simplifies the analysis of ongoing investments. It allows investors to:

- - Identify holding periods to take advantage of tax reductions.

- - Analyze unrealized gains and losses with visual highlights.

- - Assess the impact of exchange rate fluctuations.

How much is your time really worth?

Consider the value of your time and the peace of mind that comes with having a reliable and accurate tool to handle your tax reporting

(not a subscription, no auto renewal)

Premium

All features, for Revolut, Degiro, eToro, XTB, Trading212, Interactive Brokers, Freedom24, Lightyear, Trade Republic, Coinbase, Robinhood Crypto,...

- Support for all brokers and currencies

- Automatic calculation of capital gains

- Report with Acquisitions, Realizations, Dividends, and Interest

- Open positions report and statistics

- Transaction and dividends statistics

- Export Open Positions to Yahoo Finance

Business

All premium features, for accountants, financial advisors, tax consultants, or other professionals and companies wanting to use Tax-Wizard for multiple clients.

- Support for all brokers and currencies

- Automatic calculation of capital gains

- Report with Acquisitions, Realizations, Dividends, and Interest

- Open positions report and statistics

- Transaction and dividends statistics

- Export Open Positions to Yahoo Finance